9: Depreciation 119

File name : English-M02-1-040308(Print).doc Print data : 2004/3/9

25 Tabular value, year 2.

Deduction in second year.

20 Tabular value, year 3.

Deduction in third year.

Partial-Year Depreciation

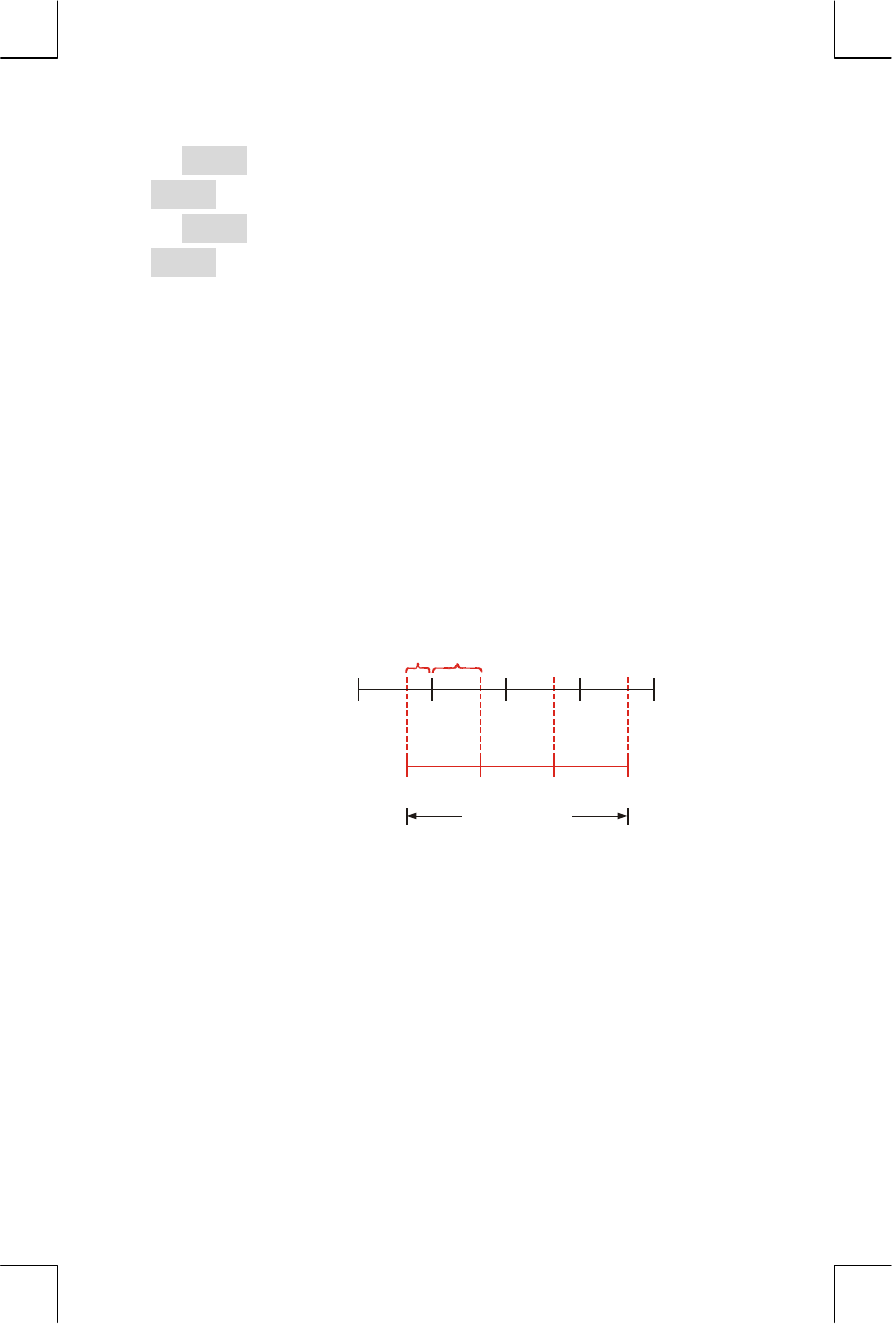

When the acquisition date of an asset does not coincide with the start of

the tax or fiscal year, then the amounts of depreciation in the first and

last years are computed as fractions of a full year’s depreciation. Except

in SL, the intermediate years are computed as sums of fractions. This

does not apply to the ACRS method.

Suppose you acquired an asset in October and wanted to depreciate it

for 3 years. (Your fiscal year begins January 1st.) The depreciation

schedule would affect parts of 4 years, as shown in the illustration. The

3 months from October to December equal ¼ year.

Number of months

Calendar

years

Depreciation

years

1

1

2

2

3

3

4

39

3-year life

For SL depreciation, partial-year calculations are easy: calculate the SL

value, then use ¼ of that value for the first year, the full amount the

second and third years, and ¾ of that amount the fourth year.

For DB and SOYD depreciation, each year’s depreciation value is

different, as shown in the table: