34

Consecutive

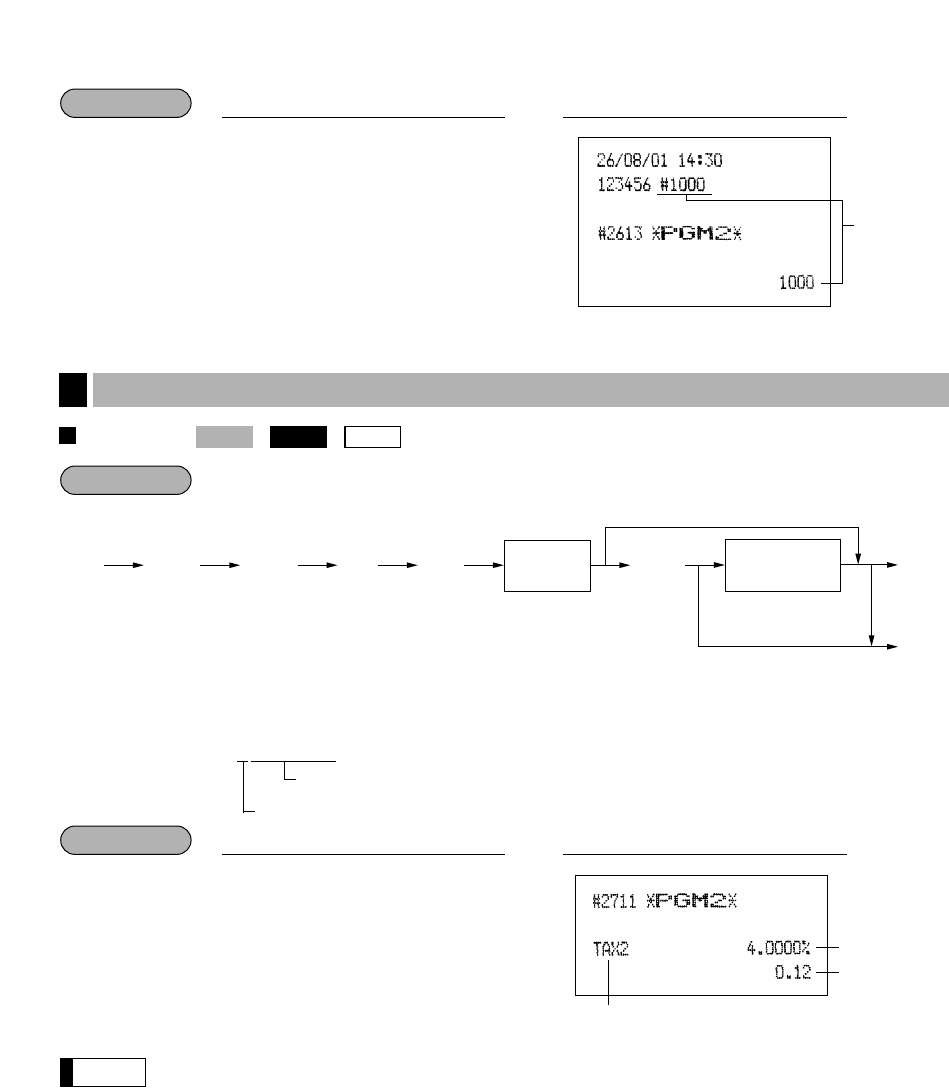

number

2613

.≈

1000

;

PrintKey operation

Example

Tax rate

*A: Enter a corresponding tax rate number. For example, when you program a tax rate as tax rate 1, enter 1

and when you program it as tax rate 6, enter 6.

** Sign and tax rate: XYYY.YYYY

• The lowest taxable amount is valid only when you select add on tax system. If you select VAT

(Value added system), it is ignored.

• If you make an incorrect entry before pressing the third

≈

key in programming a tax rate, cancel

it with the

c

key; and if you make an error after pressing the third

≈

key, cancel it with the

:

key. Then program again from the beginning correctly.

• If you select VAT system, the sign which you program is ignored.

Note

Lowest taxable

amount

Tax rate 2

Tax rate : 4%

2711

.≈

2

≈

4

≈

12

;

PrintKey operation

Example

2711

*

A

.

≈

≈

≈

;

:

When the lowest taxable amount is zero

To delete

max. five digits:

0.00 to 999.99

1 to 6

Lowest taxable

amount

**Sign and

tax rate

Procedure

Direct2711

PGM 2

Programming the tax rate

3

Tax rate= 0.0001 to 100.0000

Sign

-

/+ =

1

/0