Using the Finance Solver 10-3

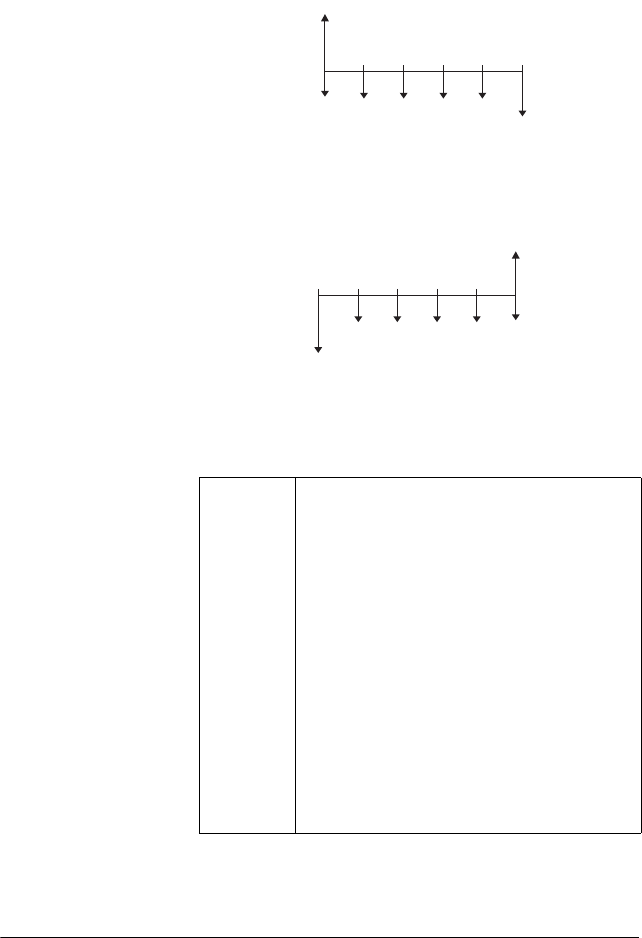

modes: Begin mode and End mode. The following cash

flow diagram shows lease payments at the beginning of

each period.

The following cash flow diagram shows deposits into an

account at the end of each period.

As these cash-flow diagrams imply, there are five TVM

variables:

PV

1

23

4

5

FV

Capitalized

value of

lease

}

PMT PMT PMT PMTPMT

PV

1

23

4

5

FV

PMT PMT PMT PMT PMT

N The total number of compounding periods

or payments.

I%YR The nominal annual interest rate (or

investment rate). This rate is divided by

the number of payments per year (P/YR)

to compute the nominal interest rate per

compounding period -- which is the

interest rate actually used in TVM

calculations.

PV

The present value of the initial cash flow.

To a lender or borrower, PV is the amount

of the loan; to an investor, PV is the initial

investment. PV always occurs at the

beginning of the first period.