10-6 Using the Finance Solver

Example 2 - Mortgage with balloon payment

Suppose you have taken out a 30-year, $150,000 house

mortgage at 6.5% annual interest. You expect to sell the

house in 10 years, repaying the loan in a balloon

payment. Find the size of the balloon payment -- the

value of the mortgage after 10 years of payment.

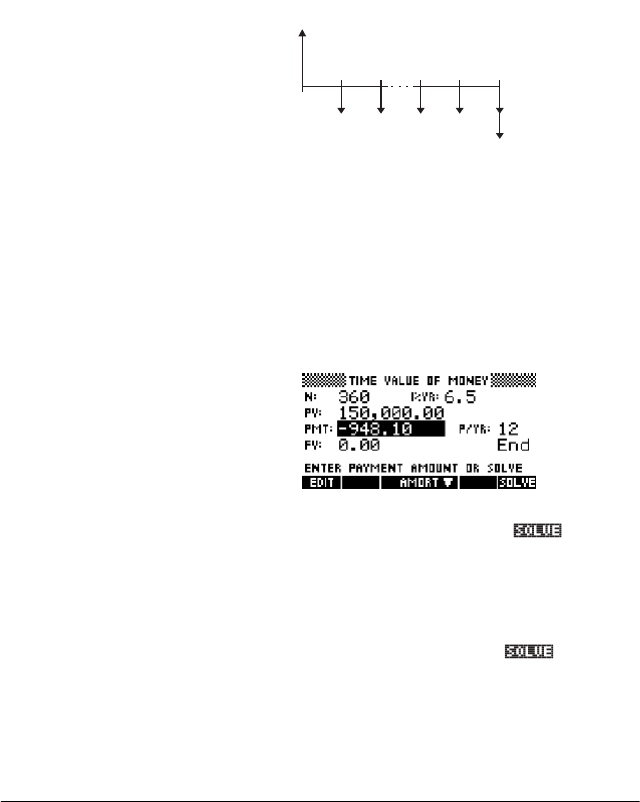

Solution. The following cash flow diagram illustrates the

case of the mortgage with balloon payment:

• Start the Finance Solver, selecting P/YR = 12 and

End payment option.

• Enter the known TVM variables as shown in the

diagram above. Your input form, for calculating

monthly payments for the 30-yr mortgage, should

look as follows:

• Highlighting the PMT field, press the soft

menu key to obtain a payment of -948.10 (i.e., PMT

= -$948.10)

• To determine the balloon payment or future value (FV)

for the mortgage after 10 years, use N = 120,

highlight the FV field, and press the soft menu

key. The resulting value is FV = -$127,164.19. The

negative value indicates a payment from the

homeowner. Check that the required balloon

payments at the end of 20 years (N=240) and 25

years (N = 300) are -$83,497.92 and

-$48,456.24, respectively.

PV = $150,000

1

2

59

60

l%YR = 6.5

N = 30 x 12 = 360 (for PMT)

N = 10 x 12 = 120 (for balloon payment)

P/YR = 12; End mode

PMT = ?

Balloon payment,

FV = ?