Using the Finance Solver 10-5

Example 1 - Loan calculations

Suppose you finance the purchase of a car with a 5-year

loan at 5.5% annual interest, compounded monthly. The

purchase price of the car is $19,500, and the down

payment is $3,000. What are the required monthly

payments? What is the largest loan you can afford if your

maximum monthly payment is $300? Assume that the

payments start at the end of the first period.

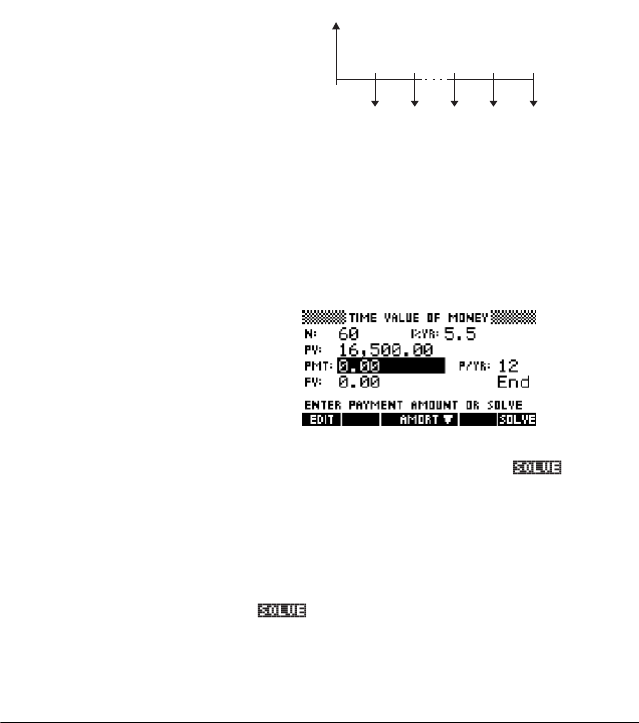

Solution. The following cash flow diagram illustrates the

loan calculations:

Start the Finance Solver, selecting P/YR = 12 and End

payment option.

• Enter the known TVM variables as shown in the

diagram above. Your input form should look as

follows:

• Highlighting the PMT field, press the soft

menu key to obtain a payment of -315.17 (i.e., PMT

= -$315.17).

• To determine the maximum loan possible if the

monthly payments are only $300, type the value -

300 in the PMT field, highlight the PV field, and press

the soft menu key. The resulting value is PV =

$15,705.85.

PV = $16,500

1

2

59

60

FV = 0

l%YR = 5.5

N = 5 x 12 = 60

P/YR = 12; End mode

PMT = ?