130

6. If you invest the same amount ($1500, *after taxes for a not-Keogh or IRA

account.) each year with dividends taxed as ordinary income, what will be

the total tax-paid cash at retirement?

7. What is the purchasing power of that figure in terms of today's dollars?

Stock Portfolio Evaluation and Analysis

This program evaluates a portfolio of stocks given the current market price

per share and the annual dividend. The user inputs the initial purchase

price of a stock, the number of shares, the beta coefficient*, the annual

dividend, and the current market price for a portfolio of any size.

The program returns the percent change in value of each stock and the

valuation and beta coefficient* of the entire portfolio. Output includes the

original portfolio value, the new portfolio value, the percent change in the

value and the annual dividend and yield as a percent of the current market

value. The overall beta coefficient of the portfolio is also calculated.

*The beta coefficient is a measure of a stock variability (risk) compared to

the market in general. Beta values for individual stocks can be acquired

from brokers, investment publications or the local business library.

Notes:

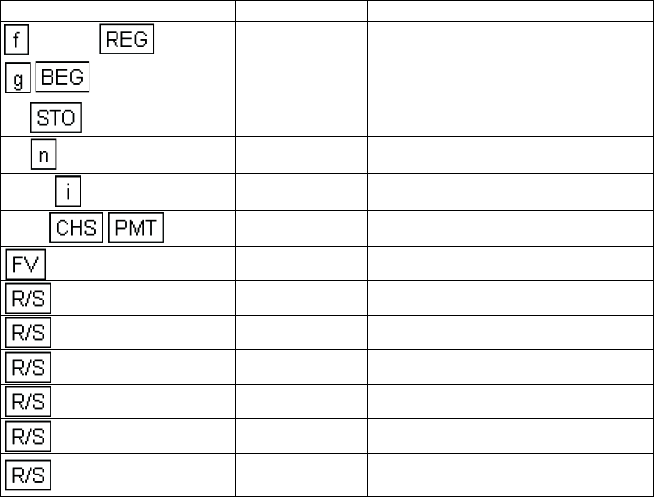

Keystrokes Display

CLEAR

40 1

40.00 Tax rate.

35

35.00 Years to retirement.

8.175

8.18 Dividend rate.

1500

-1,500.00 Annual payment.

290,730.34 Future value at retirement.

-52,500.00 Cash Paid in.

238,230.34 Earned dividends.

232,584.27 After-tax value.

8,276.30 Diminished purchasing power.

139,360.09 Tax-paid cash at retirement.

4,959.00

Purchasing power of tax-paid cash

at retirement.