67

8. Key in the purchase date (MM.DDYYYY) and press .

9. Key in the assumed sell date (MM.DDYYYY) and press to find the

after-tax yield (as a percentage).

10. For the same bond but different date return to step 8.

11. For a new case return to step 2.

Example: You can buy a 7% bond on October 1, 1981 for $70 and expect

to sell it in 5 years for $90. What is your net (after-tax) yield over the 5-

year period if interim coupon payments are considered as income, and

your tax bracket is 50%?

(One-half of the long term capital gain is taxable at 50%, so the tax on

capital gains alone is 25%)

Discounted Notes

A note is a written agreement to pay a sum of money plus interest at a

certain rate. Notes to not have periodic coupons, since all interest is paid

at maturity.

A discounted note is a note that is purchase below its face value. The

following HP 12C program finds the price and/or yield* (*The yield is a

reflection of the return on an investment) of a discounted note.

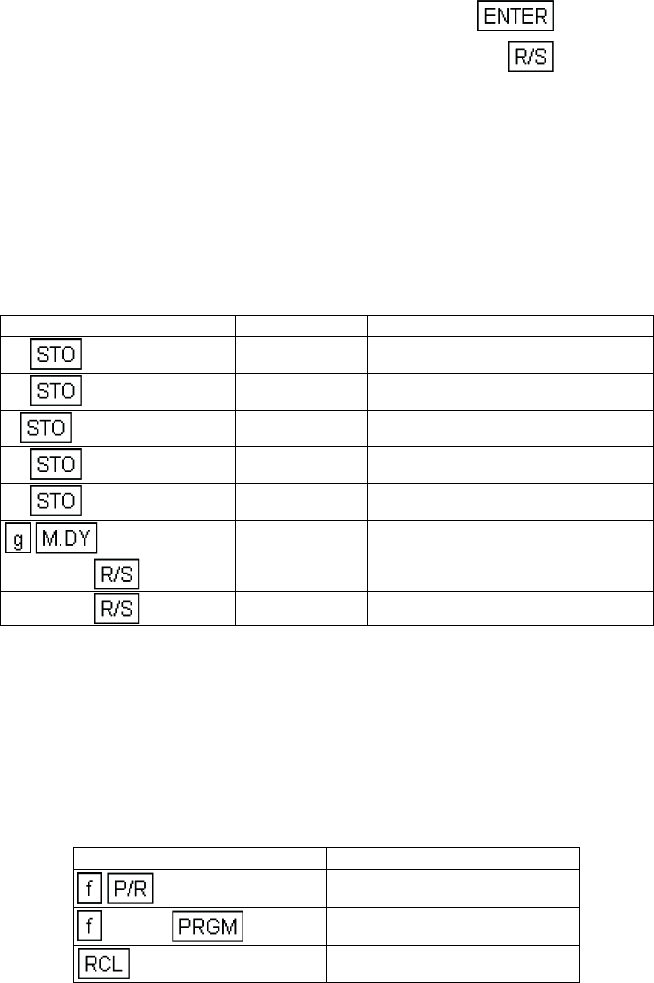

Keystrokes Display

70 1

10.00 Purchase price.

90 2

90.00 Selling price.

7 3

7.00 Annual coupon rate.

25 4

25.00 Capital gains tax rate.

50 5

50.00 Income tax rate.

10.011981

10.01 Purchase Date.

10.011986

8.53 % after tax yield.

KEYSTROKES DISPLAY

CLEAR

00-

1

01- 45 1