29

1. Key in the program.

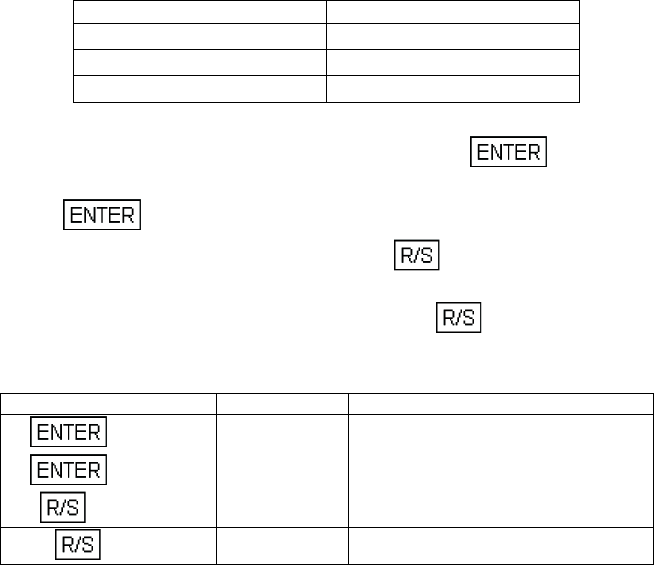

2. Key in the number of months in the loan and press .

3. Key in the payment number when prepayment occurs and press

.

4. Key in the total finance charge and press to obtain the unearned

interest (rebate).

5. Key in the periodic payment amount and press to find the amount of

principal outstanding.

6. For a new case return to step 2.

Graduated Payment Mortgages

The Graduated Payment Mortgage is designed to meet the needs of

young home buyers who currently cannot afford high mortgage payments,

but who have the potential of increasing earning in the years on come.

Under the Graduated Payment Mortgage plan, the payments increase by

a fixed percentage at the end of each year for a specified number of years.

Thereafter, the payment amount remains constant for remaining life of the

mortgage.

The result is that the borrower pays a reduced payment (a payment which

is less than a traditional mortgage payment) in the early years, and in the

later years makes larger payments than he would with a traditional loan.

Over the entire term of the mortgage, the borrower would pay more than

he would with conventional financing.

Given the term of the mortgage (in years), the annual percentage rate, the

loan amount, the percentage that the payments increase, and the number

of years that the payments increase, the following HP-12C program

determines the monthly payments and remaining balance for each year

until the level payment is reached.

PV: Unused PMT: Unused

FV: Unused

R

0

: Fin. charge

R

1

: Payment# R

2

: # moths

R

3

-R

.6

: Unused

Keystrokes Display

30

25

180

5.81 Rebate.

39.33

190.84 Outstanding principal.