52

Break-Even Analysis

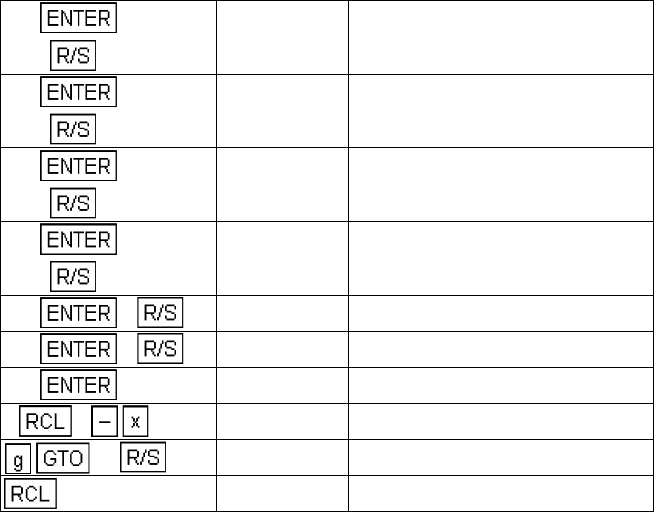

Break-even analysis is basically a technique for analyzing the

relationships among fixed costs, variable costs, and income. Until the

break even point is reached at the intersection of the total income and

total cost lines, the producer operates at a loss. After the break-even point

each unit produced and sold makes a profit. Break even analysis may be

represented as follows.

200

1700

-628.09 5th year.

200

1700

-226.44 6th year.

200

1700

-309.48 7th year.

200

1700

-388.81 8th year.

300 0

-1,034.72 9th year.

300 0

-1,080.88 10th year.

750

750.00 Buy back.

1 3

390.00 After tax buy back expense.

43

239.43 Present value.

2

-150.49 Net lease advantage.