50

8. For declining balance depreciation, key in the depreciation factor (as a

percentage) and press 7.

9. Key in the total first lease payment (including any advance payments) and

press 1 3 2.

10. Key in the first year's maintenance expense that would be anticipated if the

asset was owned and press . If the lease contract does not include

maintenance, then it is not a factor in the lease vs. purchase decision and

0 expense should be used.

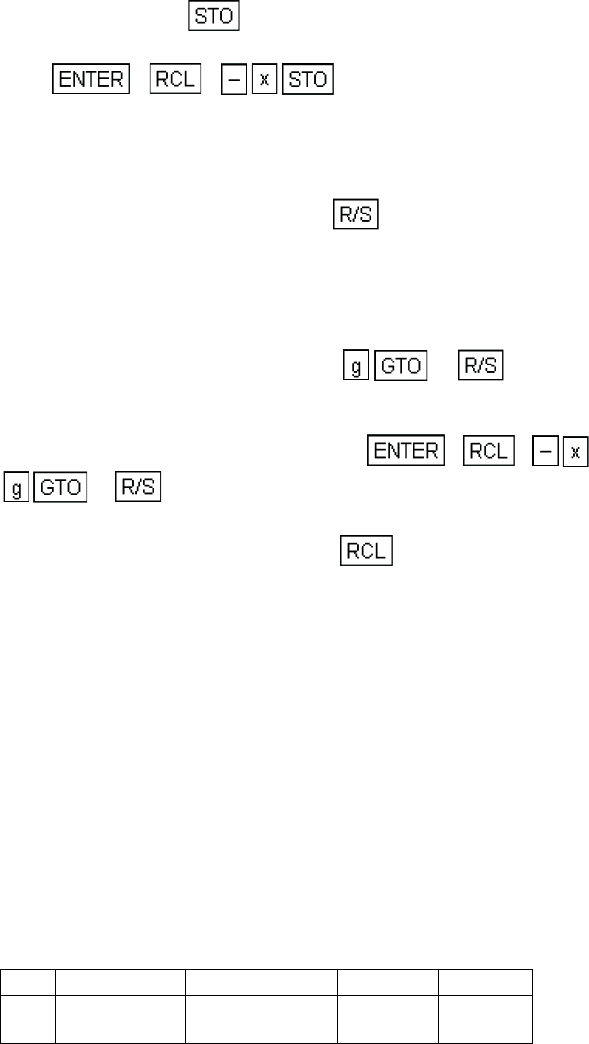

11. Key in the next lease payment and press . During any year in which

a lease payment does not occur (e.g. the last several payments of an

advance payment contract) use 0 for the payment.

12. Repeat steps 10 and 11 for all maintenance expenses and lease payments

over the term of the analysis. Optional - If the investment tax credit is

taken, key in the amount of the credit after finishing steps 10 and 11 for the

year in which the credit is taken and press 43 . Continue

steps 10 and 11 for the remainder of the term.

13. After all the lease payments and expenses have been entered (steps 10 and

11), key in the lease buy back option and press 1 3

43 . If no buy back option exists, use the estimated salvage

value of the purchased equipment at the end of the term.

14. To find the net advantage of owning press 2. A negative value

represents a net lease advantage.

Example: Home Style Bagel Company is evaluating the acquisition of a mixer

which can be leased for $1700 a year with the first and last payments in advance

and a $750 buy back option at the end of 10 years (maintenance is included).

The same equipment could be purchased for $10,000 with a 12% loan

amortized over 10 years. Ownership maintenance is estimated to be 2% of the

purchase price per year for the first for years. A major overhaul is predicted for

the 5th year at a cost of $1500. Subsequent yearly maintenance of 3% is

estimated for the remainder of the 10-year term. The company would use sum

of the years digits depreciation on a 10 year life with $1500 salvage value. An

accountant informs management to take the 10% capital investment tax credit

at the end of the second year and to figure the cash flows at a 48% tax rate.

The after tax cost of capital (discounting rate) is 5 percent.

Because lease payments are made in advance and standard loan

payments are made in arrears the following cash flow schedule is

appropriate for a lease with the last payment in advance.

Year Maintenance Lease Payment Tax Credit Buy Back

0

1200

1700+700

1700