15

After-Tax Net Cash Proceeds of Resale

The After-Tax Net Cash Proceeds of Resale (ATNCPR) is the after-tax

reversion to equity; generally, the estimated resale price of the property

less commissions, outstanding debt and any tax claim.

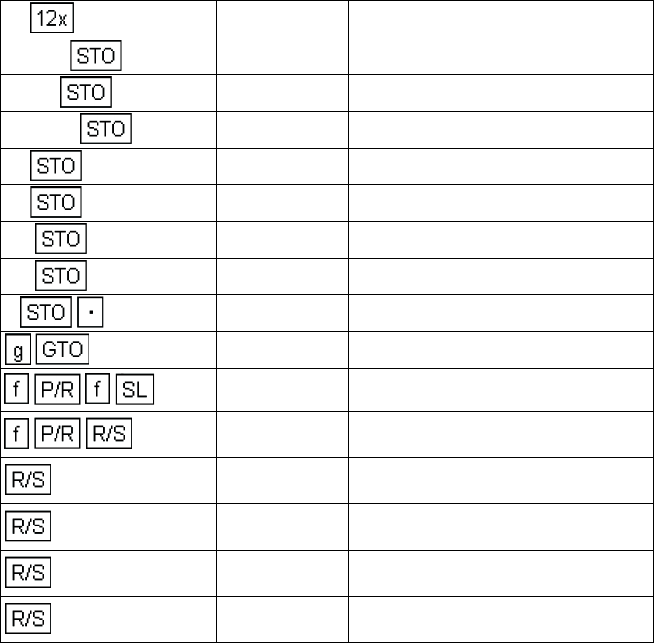

The After-Tax Net Cash Proceeds can be found using the HP-12C

program which follows. In calculating the owner's income tax liability on

resale, this program assumes that the owner elects to have his capital

gain taxed at 40% of his Marginal Tax Rate. This assumption is in

accordance with a 1978 Federal tax ruling.* (*Federal Taxes, code sec.

1202 (32,036))

This program uses declining balance depreciation to find the amount of

depreciation from purchase to sale. This amount is used to determine the

excess depreciation (which is equal to the amount of actual depreciation

minus the amount of the straight line depreciation).

25

175200 2

40296 3

40,296.00 1st year operating cost.

1200000 4

1,200,000.00 Depreciable value.

35 5

35.00 Depreciable life.

50 7

50.00 Marginal tax rate.

3.5 8

3.50 Potential Gross Income

1.6 9

1.60 Operating cost growth rate.

7 0

7.00 Vacancy rate.

31

7.00 Go to dep. step.

32- 42

23

Change to SL.

1.00

18,021.07

Year 1

ATCF

1

2.00

20,014.26

Year 2

ATCF

2

3.00

22,048.90

Year 3

ATCF

3

4.00

24,123.14

Year 4

ATCF

4

5.00

26,234.69

Year 5

ATCF

5