3

Wrap-Around Mortgage

A wrap-around mortgage is essentially the same as a refinancing mortgage,

except that the new mortgage is granted by a different lender, who assumes

the payments on the existing mortgage, which remains in full force. The new

(second) mortgage is thus “wrapped around” the existing mortgage. The

"wrap-around" lender advances the net difference between the new

(second) mortgage and the existing mortgage in cash to the borrower, and

receives as net cash flow, the difference between debt service on the new

(second) mortgage and debt service on the existing mortgage.

When the terms of the original mortgage and the wrap-around are the

same, the procedures in calculating NPV and IRR to the lender and NPV

to the borrower are exactly the same as those presented in the preceding

section on refinancing.

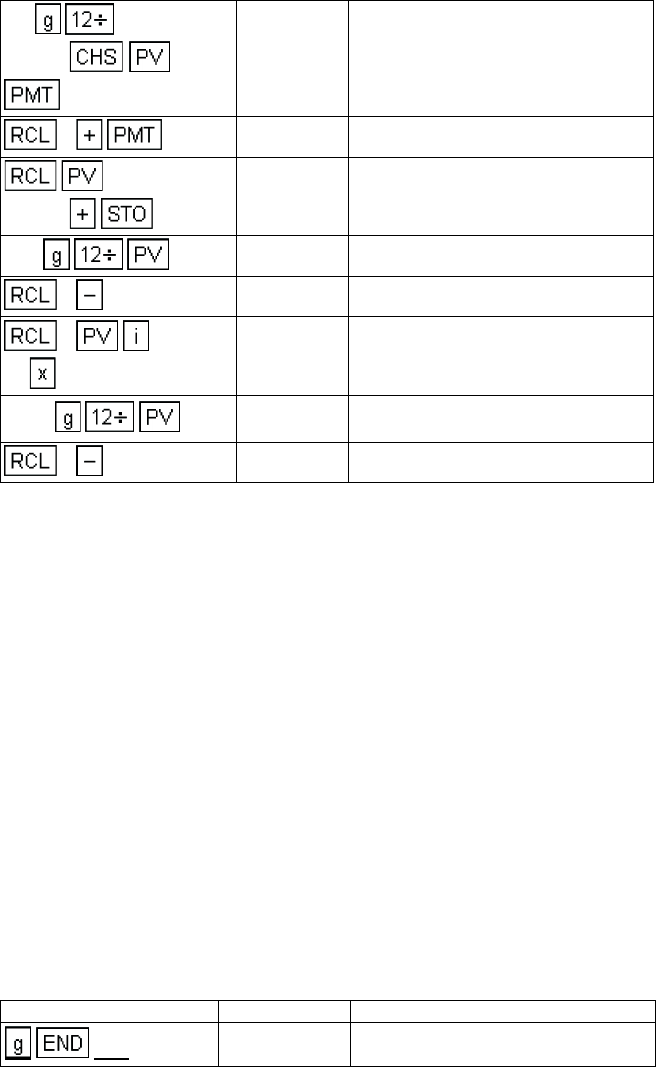

Example 1: A mortgage loan on an income property has a remaining

balance of $200,132.06. When the load originated 8 years ago, it had a 20-

year term with full amortization in level monthly payments at 6.75% interest.

A lender has agreed to “wrap” a $300,000 second mortgage at 10%, with

full amortization in level monthly payments over 12 years. What is the

effective yield (IRR) to the lender on the net cash advanced?

9.5

200000

1,979.56 Monthly payment on new mortgage.

0

899.23 Net monthly payment (to lender).

133190 0

-66,810.00

Net amount of cash advanced (by

lender).

11.5

-80,425.02 Present value of net

0

-13,615.02 NPV to lender of net cash advanced

0

12

14.83 % nominal yield (IRR).

15.25

-65,376.72

Present value of net monthly

payment at 15.25%.

0

1,433.28 NPV to borrower.

Keystrokes Display

144.00

Total number of months remaining in

original load (into n).