47

Investment Analysis

Lease vs. Purchase

An investment decision frequently encountered is the decision to lease or

purchase capital equipment or buildings. Although a thorough evaluation

of a complex acquisition usually requires the services of a qualified

accountant, it is possible to simplify a number of the assumptions to

produce a first approximation.

The following HP-12C program assumes that the purchase is financed

with a loan and that the loan is made for the term of the lease. The tax

advantages of interest paid, depreciation, and the investment credit which

accrues from ownership are compared to the tax advantage of treating the

lease payment as an expense. The resulting cash flows are discounted to

the present at the firm's after-tax cost of capital.

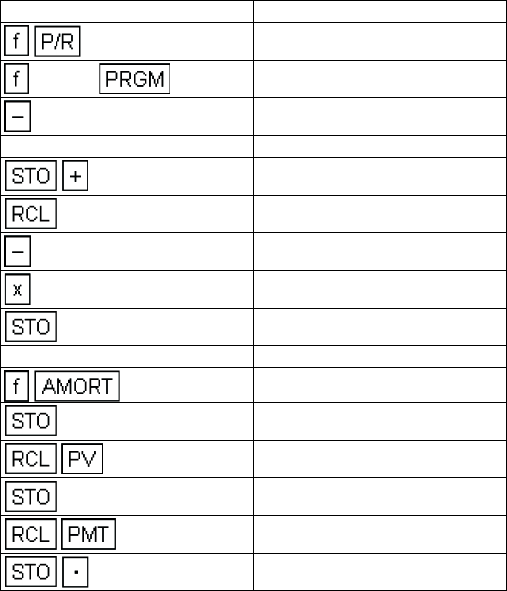

KEYSTROKES DISPLAY

CLEAR

00-

01- 30

1 02- 1

0

03-44 40 0

3

04- 45 3

05- 30

06- 20

8

07- 44 8

1 08- 1

09- 42 11

1

10- 44 1

11- 45 13

9

12- 44 9

13- 45 14

14-44 48 0