21

Add-On Interest Rate Converted to APR

An add-on interest rate determines what portion of the principal will be

added on for repayment of a loan. This sum is then divided by the number

of months in a loan to determine the monthly payment. For example, a

10% add-on rate for 36 months on $3000 means add one-tenth of $3000

for 3 years (300 x 3) - usually called the "finance charge" - for a total of

$3900. The monthly payment is $3900/36.

This keystroke procedure converts an add-on interest rate to a annual

percentage rate when the add-on rate and number of months are known.

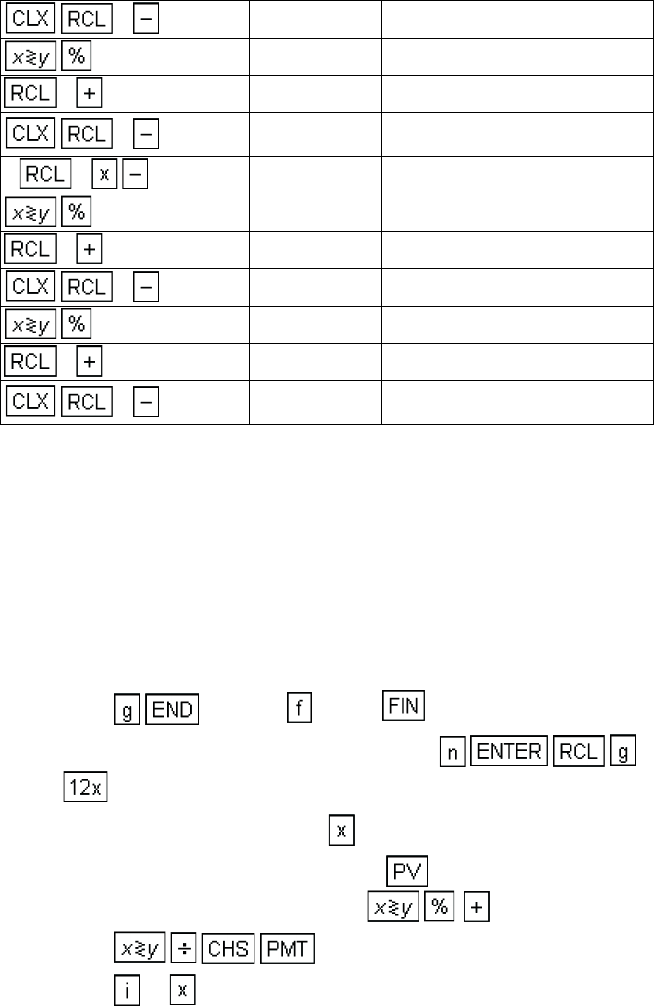

1. Press and press CLEAR .

2. Key in the number of months in loan and press

.

3. Key in the add-on rate and press .

4. Key in the amount of the loan and press * (*Positive for cash

received; negative for cash paid out.) .

5. Press .

6. Press 12 to obtain the APR.

0

55,000.00 Remaining balance.

2,750.00 Second payment's interest.

0

7,750.00 Total second payment.

0

50,000.00

Remaining balance after the first

year.

4 0

1,500.00 Seventh payment's interest.

0

6,500.00 Total seventh payment.

0

25,000.00 Remaining balance.

1,250.00 Eighth payment's interest.

0

6,250.00 Total eighth payment.

0

20,000.00

Remaining balance after fourth

year.