9: Depreciation 115

File name : 17BII-Plus-Manual-E-PRINT-030709 Print data : 2003/7/11

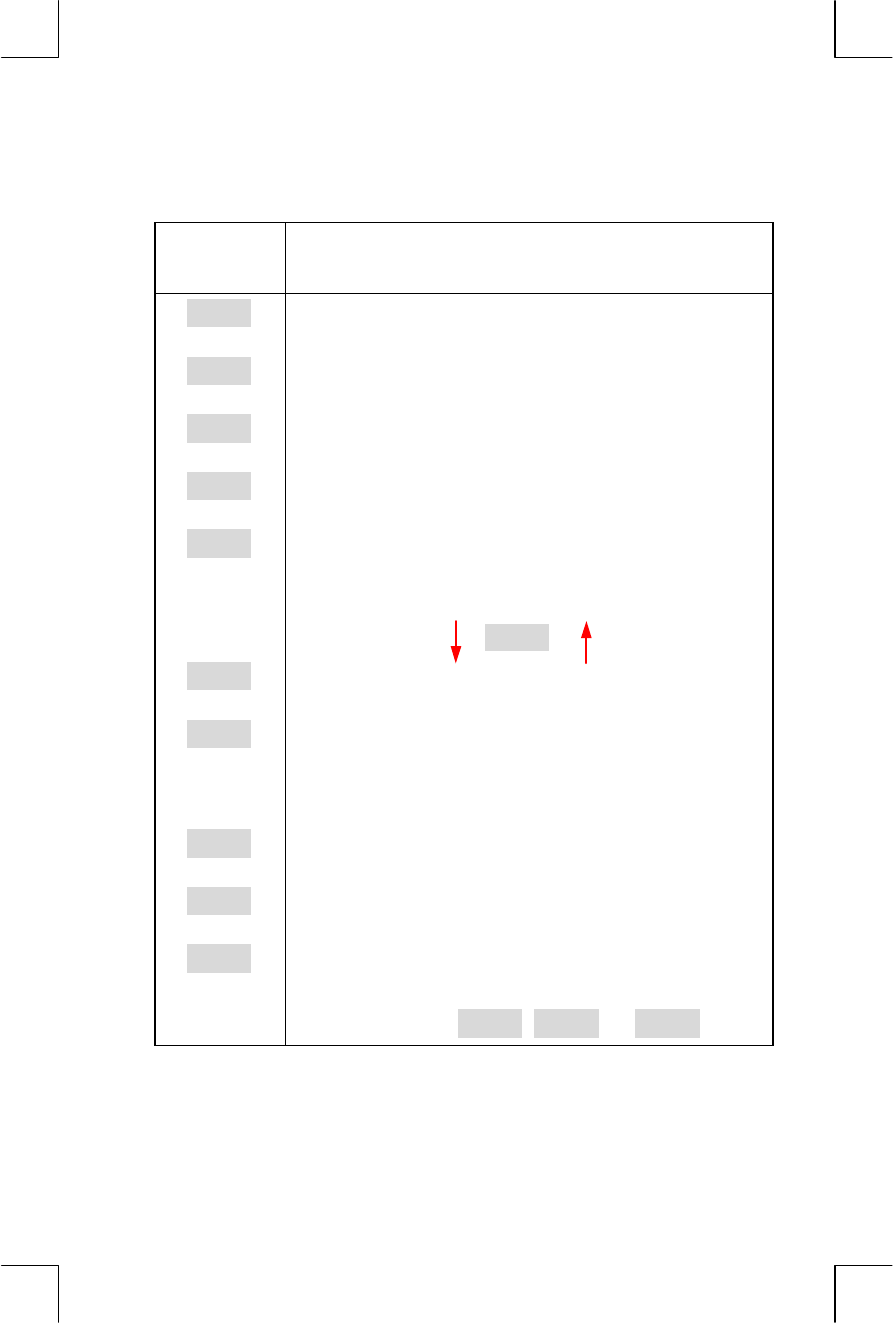

Table 9-1. DEPRC Menu Labels

Menu

Label

Description

†

Stores the depreciable cost basis of the asset at

acquisition.

‡

!

Stores the salvage value of the asset at the end of its

useful life. If there is no salvage value, set SALV=0.

ˆ

!

Stores the expected useful life (in whole years) of the

asset.

‰

!

Stores the appropriate Accelerated Cost Recovery

System percentage from the published ACRS tables.

Calculates the ACRS deduction based on BASIS and

ACRS%. (The values in SALV, LIFE, FACT%, and YR#

do not matter.)

Š

!

)

‹

!

Stores the number of the year for which you want the

depreciation (1, 2, etc.).

Œ

!

Stores the declining-balance factor as a percentage

of the straight-line rate. This is for the DB method only.

For example, for a rate 1¼ times (125%) the

straight-line rate, enter 125.

•

!

Calculates the declining-balance depreciation for the

year.

Ž

!

Calculates the sum-of-the-years‘-digits depreciation for

the year.

•

!

Calculates the straight-line depreciation for the year.

]

!

Displays the remaining depreciable value, RDV, after

you have pressed

•

,

Ž

, or

•

.

The calculator retains the values of the DEPRC variables until you clear

them by pressing

@c

while the DEPRC menu is displayed.