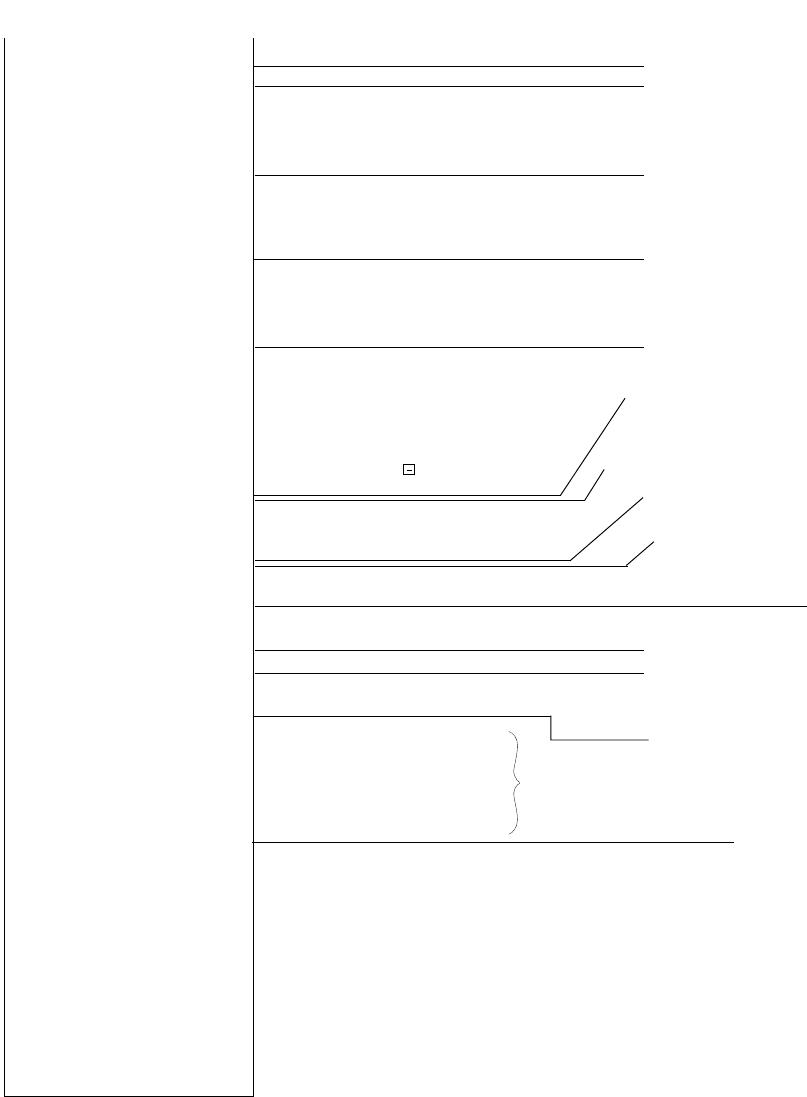

- 16 -

EO1-11113

<

<

Item Correct (on positive Depts/PLUs) Count

& Amount

Void Count

& Amount

All Void Count

& Amount

Percent Discount (on Line Items) Count

& Amount

Dollar Discount (on Line Items) Count

& Amount

Store Coupon Item Count

& Amount

Returned Merchandise Item Count

& Amount

Negative Tax Amount

Negative-balance Sales

Customer Count & Amount

Negative Mode ( Mode) Count

& Amount

Transfer - Daily

Previous Balance Sales

Customer Count & Amount

Taxable Total 1 (Sale Amount Portion subject to Tax 1 taxation)

Taxable Total 2 (Sale Amount Portion subject to Tax 2 taxation)

Selective Itemizer 1 Count

& Amount calculated out or processed

Tax Exempted Customer Count

Sale Portion Exempted from GST

Sale Portion Exempted from Tax 1

Foreign Currency Rounding Amount

Sales Item Count per Customer

Net Sale Amount per Customer

No-sale Count

Validation Print Count

Tray Total Operation Count

Financial Reset Report Count (on Reset Reports only)

*

*

*

*

*

*

*

*

Takeout Customer Count & Amount

*

Foreign Currencies 4 &

5-in-drawer data if

opened.

<

<

CORR 1

$1.00

VOID 1

$1.00

ALL VD 2

$8.60

%- 11

$2.02

DISC 4

$2.00

S. CPN 2

$1.00

RTN 4

$3.80

-TAX $0.22

-SALE 4CU

$5.37

REG- 2

$7.95

TRF- $0.03

PB TL 1CU

$0.00

TXBL1 $284.98

TXBL2 $58.20

SI1 TL 2

$1.40

TAX EX 1CU

GST EX $5.00

TAX1 EX $10.00

CUR 1 3

150.00

CUR 2 1

5.68

CUR 3 1

1.45

CUR RND 18.00

ITEM/CUS 1.58

NS/CUS $4.23

NO SALE 3

VALI CTR 2

TRAY CTR 1

0001Z

0260 18:58TM

(Financial Read or Reset)

-- Continued --

Eat-in Customer Count & Amount

<

Miscellaneous Void Count & Amount

<

Percent Discount II (on Line Items) Count &

Amount if two Percent Discount keys are

installed.

<

Negative Departments Item Count & Amount

<

Transfer + Daily

<

Transfer GT Balance, Transfer+GT and

Transfer-GT (These items are non-resettable)

if the Check Track feature is selected.

GST Taxable Total

<

Previous Balance R/A and Previous Balance

PO if the Check Track feature is selected.

Taxable Total 3,4

<

Selective Itemizer 2 Count & Amount

<

FS EX1 to FS EX4 for Taxes exempted by

tendering food stamps if ILLINOIS or NEW

JERSEY type of food stamp system

<

Sales Portion Exempted from Tax 2 to 4

<

The amounts are expressed in the

respective currencies’ units