94

Programming SAM4s ER-5115 Electronic Cash Register

Straight Percentage Tax Rate Programming

When tax requirements may be met using a straight percentage rate, use the following method to

program a tax as a straight percentage.

Programming Straight Percentage Tax Rates and Status

1. Turn the control lock to the P position.

2. If the tax is a percentage rate, with a decimal. (0.000-99.999). It is not necessary to

enter preceding zeros. For example, for 6%, enter 06.000 or 6.000.

3. For the type of tax:

If the tax is a percentage added to the sale (normal add on tax), enter:

0

If the tax is a percentage value added tax (VAT; calculated as part of the

sale), enter:

2

4. Enter 0 here for all taxes, unless if you are programming tax 4 as a Canadian GST. If

tax 4 is a Canadian GST, enter the sum of the options below:

OPTION VALUE = SUM

GST (tax 4) is taxable by rate 1? Yes = 1

No = 0

GST (tax 4) is taxable by rate 2? Yes = 2

No = 0

GST (tax 4) is taxable by rate 3? Yes = 4

No = 0

6. Press the Tax Shift key for the tax you are programming.

7. Press the CASH key to end programming.

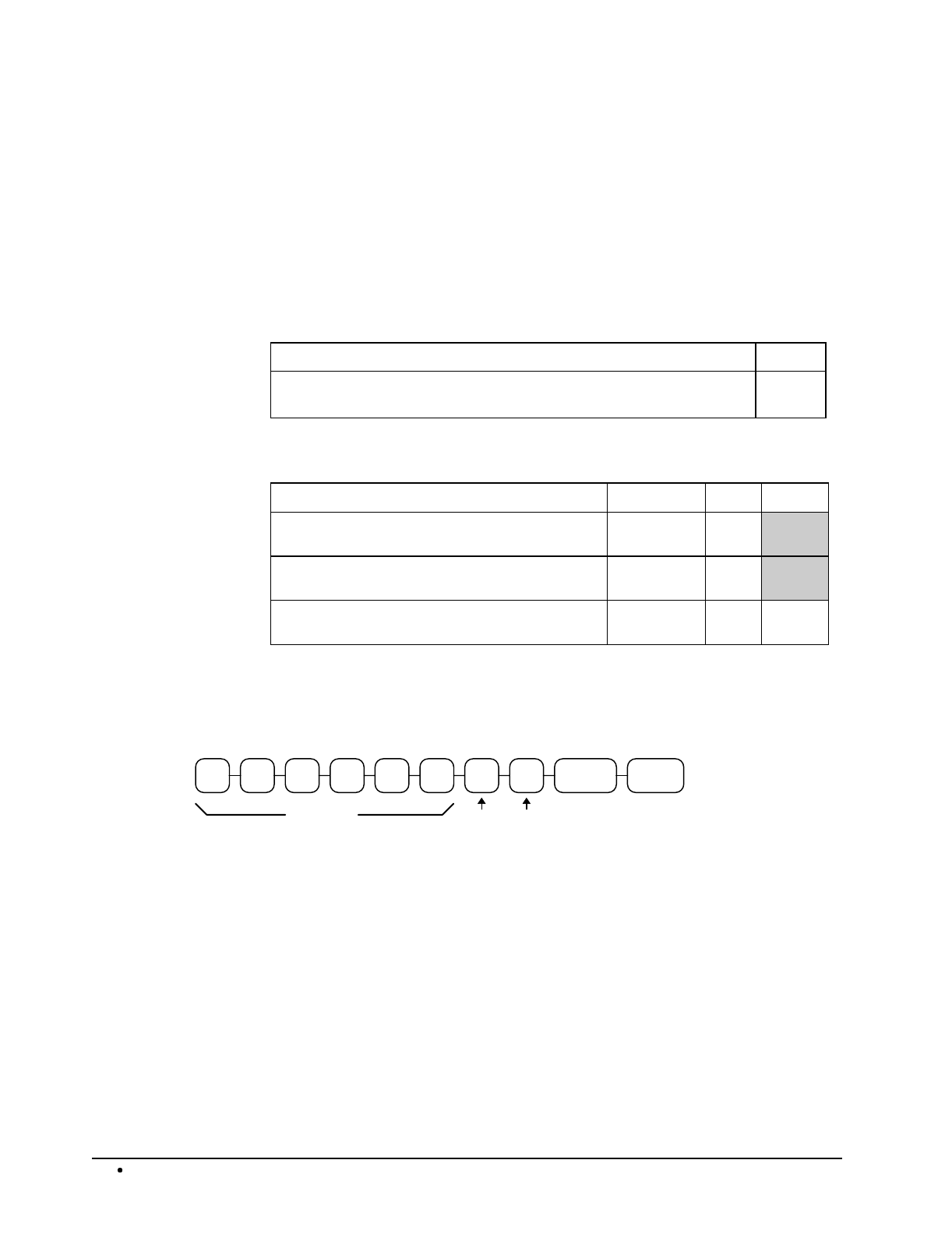

Tax Rate Programming Flowchart

.

TAX SHIFT

(

1/2/3/4

)

Tax Rate

You must enter decimal

GST

tax

Info

Tax

type

CASH