37

Part2

FOR THE OPERATOR

Part3Part1

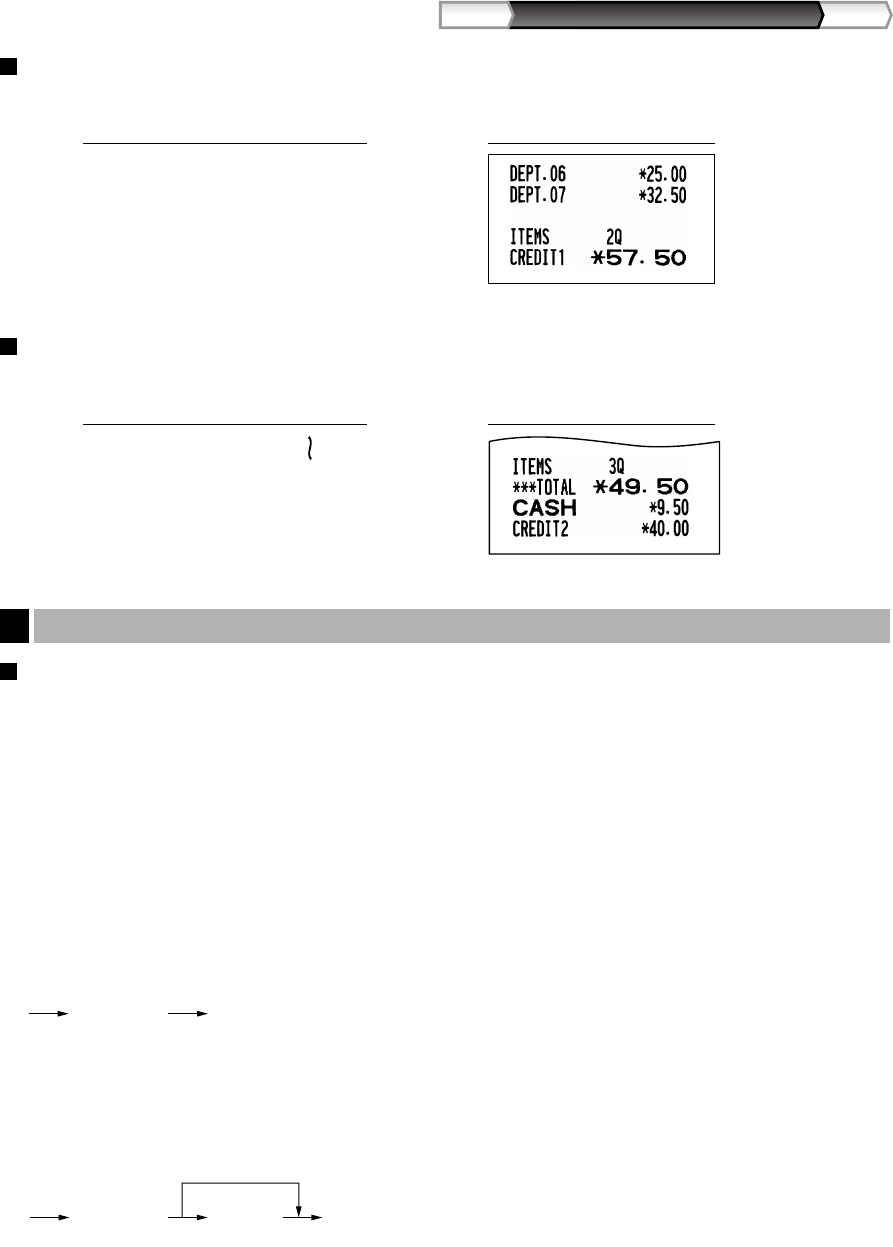

Credit sale

Enter items and press a credit key (

c

or

b

).

Mixed-tender sale

You can perform mixed-tendering of cheque and cash, cash and credit, and cheque and credit.

VAT/ tax system

The cash register may be programmed for the following six VAT/tax systems. The cash register is pre-

programmed as automatic VAT 1-4 system.

Automatic VAT 1-4 system (Automatic operation method using programmed percentages)

This system, at settlement, calculates VAT for taxable 1 through 4 subtotals by using the corresponding

programmed percentages.

Automatic tax 1-4 system (Automatic operation method using programmed percentages)

This system, at settlement, calculates taxes for taxable 1 through 4 subtotals by using the corresponding

programmed percentages, and also adds the calculated taxes to those subtotals, respectively.

Manual VAT 1-4 system (Manual entry method using programmed percentages)

This system provides the VAT calculation for taxable 1 through 4 subtotals. This calculation is performed using

the corresponding programmed percentages when the

t

key is pressed just after the

s

key.

Manual VAT 1 system (Manual entry method for subtotals that uses VAT 1 preset percentages)

This system enables the VAT calculation for the then subtotal. This calculation is performed using the VAT 1

preset percentages when the

t

key is pressed just after the

s

key. For this system, the keyed-in tax rate

can be used.

s t

VAT rate

To use a programmed rate

s t

Computation of VAT (Value Added Tax)/tax

6

s

950 A

b

Receipt printKey operation example

2500

+

3250

*

c

Receipt printKey operation example

A113_2 FOR THE OPERATOR 06.9.11 6:37 PM Page 37