- 32 -

EO1-11115

MA-186-100 SERIES

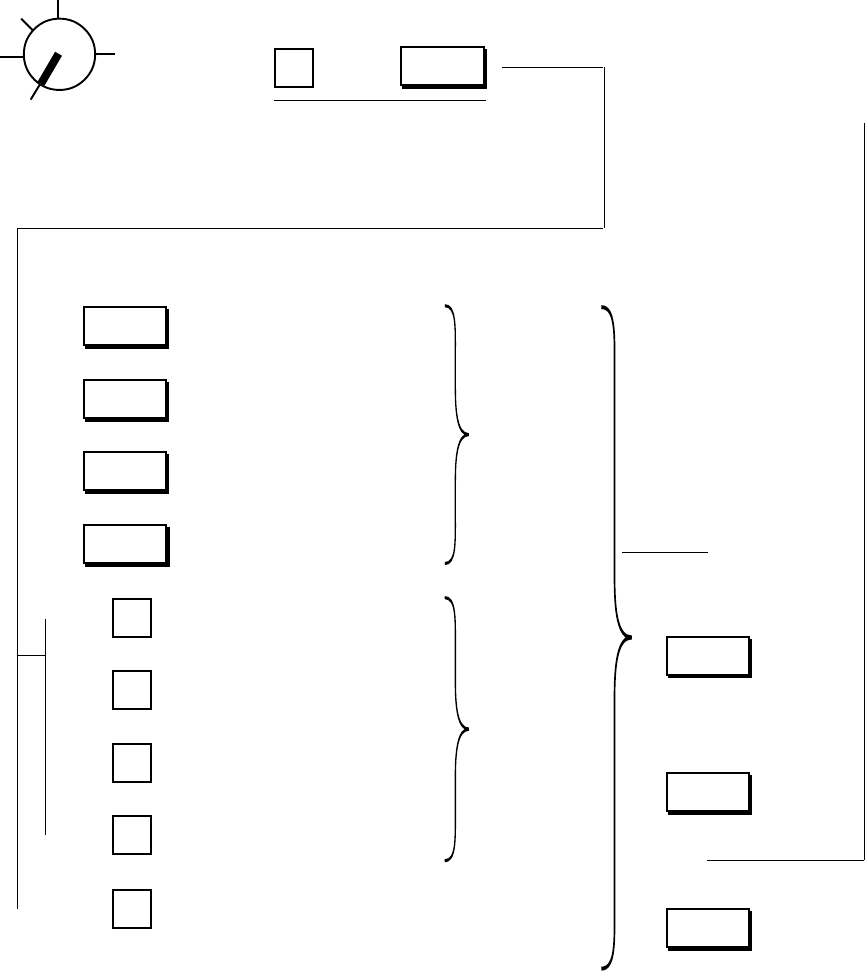

Department Status Programming:

To use Department Keys, program how each Department Key is to be used, in accordance with

merchandise categories, operativity of the key, etc.

Condition: After Daily Financial Reset and Periodical Financial Reset (and All PLU Reset if the positive/

negative status is to be set), or Any time outside a sale for other status changes.

(refer to

“NOTE on Condition” on page 15)

Programming Procedure:

Use the MA Key to turn the Control Lock to “SET”.

To set Negative status

NOTES 4, 5

To set Tax 1 taxable status

NOTES 1, 3

To set Tax 2 taxable status

NOTES 1, 3

To set GST taxable status

NOTES 1, 4

Declaration of Program No. 3

for Department Status

programming

Repeat for programming

other Department Keys.

To set Single-item Key status

Key Type status

NOTE 6

To complete this

operation and

issue a program

receipt

Depress the De-

partment Key to

obtain the selected

statuses.

NOTE 3

Depress the [DPT

SHIFT] key to set

the Department

Nos. 21 to 40.

NOTE 7

()

The status is re-

versed by press-

ing the same key

again.

NOTE 2

Z

OFF

X

REG

SET

Depress the required key(s) to obtain the appropriate

status for the department:

→ →

1

3

@/FOR

←

→

→

→

→

→

→

→

→

→

RTN

MDSE

TX1/M

GST/M

TX2/M

2

4

5

0

To set Itemized Key status

To set Other Income Dept. with

Itemized Key status

To set Other Income Dept. with

Single-item Key status

To regain the initial statuses, i.e., Positive, Non-

taxable, Non-GST and Itemized statuses); it may be

useful when you are confused with various status

selections for a department.

←

DPT

SHIFT

←

AT/TL

←

Dept.