- 73 -

EO1-11115

MA-186-100 SERIES

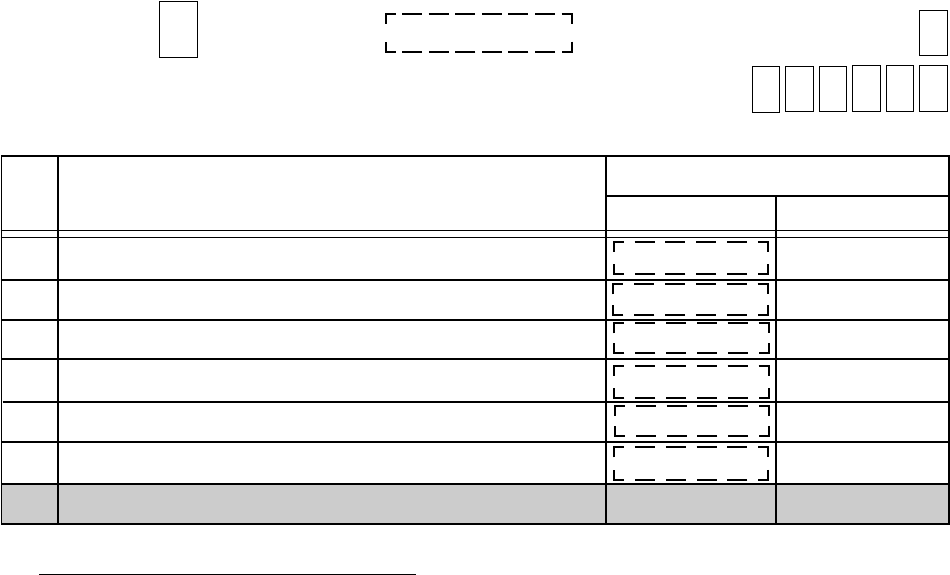

Address: 3 Initial SET Bit Nos. → 0

Your Selection →

(Tax Status)

[% +] key PST/Tax Status

[% -] key PST/Tax Status

[DOLL DISC] key PST/Tax Status

[% +] key GST Status

[% -] key GST Status

[DOLL DISC] key GST Status

-- vacant --

Content

Bit

No.

Selective Status

RESET

SET

1

2

3

4

5

6

7, 8

NON-TAXABLE

NON-TAXABLE

NON-TAXABLE

TAXABLE

TAXABLE

TAXABLE

NON-TAXABLE

GST NON-TAXABLE

GST NON-TAXABLE

GST TAXABLE

GST TAXABLE

GST NON-TAXABLE

GST TAXABLE

Supplementary Description for Address 3:

Bit 1 & Bit 2: RESET status .................... The key always operates as Non-taxable.

SET status.......................... The key becomes PST/Tax Taxable if they are used after

depressing the [ST] key. If the key is used after entering

a Department or PLU item, the key obeys the Department

PST/Tax status.

Bit 3: RESET status .................... The key always operates as Non-taxable.

SET status.......................... The key always operates as Taxable.

To make status selections of Bits 4 to 6 here, Address 14-Bit 1 “SET” status must be selected.

Bit 4 & Bit 5: RESET status .................... The keys always operates as GST Non-taxable.

SET status.......................... The key becomes GST Taxable if it is used after depress-

ing the [ST] key. If it is used after entering a Department

or PLU item, it obeys the Department GST status.

Bit 6: RESET status .................... The key always operates as GST Non-taxable.

SET status.......................... The key always operates as GST Taxable.

-- Addresses 4, 5 are vacant. --