25

(Continued)

TAX RATE

TAX TABLE RATE

Refer to Appendix 1 to locate the tax table codes listed for your particular state. If your state's tax rate is not

listed in Appendix 1, refer to Appendix 2 for instructions on calculating your own state's tax table codes.

Remember: Tax 1, Tax 2 and Tax 3 can be programmed with a Tax Table Rate.

Important: Step 1, on Page 25 must be completed before programming the Tax Table Rate.

TO PROGRAM A SINGLE TAX TABLE RATE

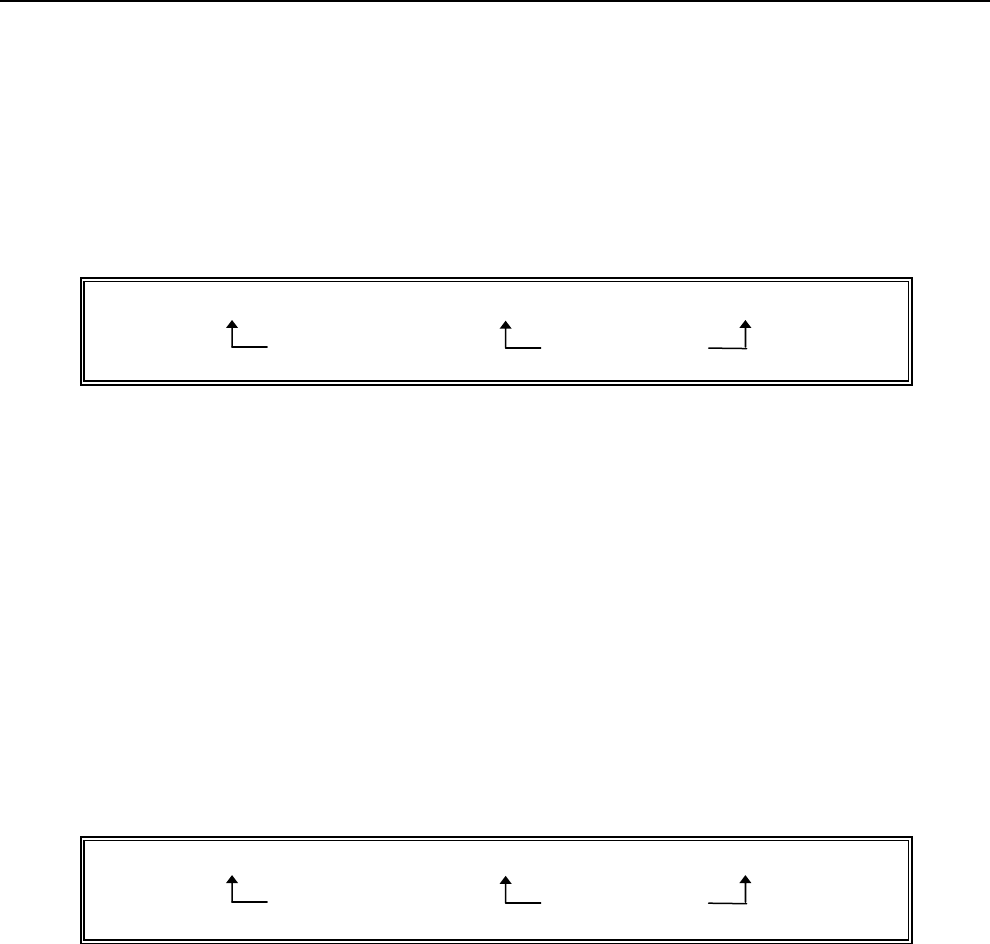

"PRG" + (ENTER TAX #) + [TAX 1] + (STATE TAX TABLE CODE) + [TAX 2] + [#/ST/NS]

1: Tax 1 + (2)

2: Tax 2 + (2) Repeat for each code

3: Tax 3 + (2)

Example: The tax code for Arizona's tax rate of 4% is: 138-100-4-13-19-23-27-27-29-25-25-25-25.

To program this under Tax 1, which you must have previously defined as a Tax Table Rate per the

instructions in Step 1:

1. Turn the key to the "PRG" (PROGRAM) position.

2. If a Manager Password has been programmed, ENTER the (PASSWORD #), then PRESS the [CLERK]

key, or if you did not program a Manager Password, go to Step 3.

3. ENTER (12), then PRESS [TAX 1] key.

4. ENTER (138), then PRESS the [TAX 2] key.

5. ENTER (100), then PRESS the [TAX 2] key.

6. Continue typing the State Tax Table Codes and PRESS the [TAX 2] key after each code until finished.

7. When finished, PRESS the [#/ST/NS] key to finalize.

NOTE: If a mistake occurs during programming the State Tax Table Codes, PRESS the [CLEAR] key and begin

again with Step 3.

TO PROGRAM A SECOND TAX TABLE RATE

"PRG" + (ENTER TAX #) + [TAX 1] + (STATE TAX TABLE CODE) + [TAX 2] + [#/ST/NS]

1: Tax 1 + (2)

2: Tax 2 + (2) Repeat for each code

3: Tax 3 + (2)

Example: The tax code for Arizona's tax rate of 5% is: 90-100-5-11-17-20-21-21-20-20-20-20-20.

To program this under Tax 2, follow the instructions in Step 1 to designate Tax 2 as a Table Tax and

then:

1. Turn the key to the "PRG" (PROGRAM) position.

2. If a Manager Password has been programmed, ENTER the (PASSWORD #), then PRESS the [CLERK]

key, or if you did not program a Manager Password, go to Step 3.

3. ENTER (22), then PRESS [TAX 1] key.

4. ENTER (90), then PRESS the [TAX 2] key.

5. ENTER (100), then PRESS the [TAX 2] key.

6. Continue typing the State Tax Table Codes mentioned and PRESS the [TAX 2] key after each code until

finished.

7. When finished, PRESS the [#/ST/NS] key to finalize.

NOTE: If a mistake occurs during programming the State Tax Table Codes, PRESS the [CLEAR] key and begin

again with Step 3.