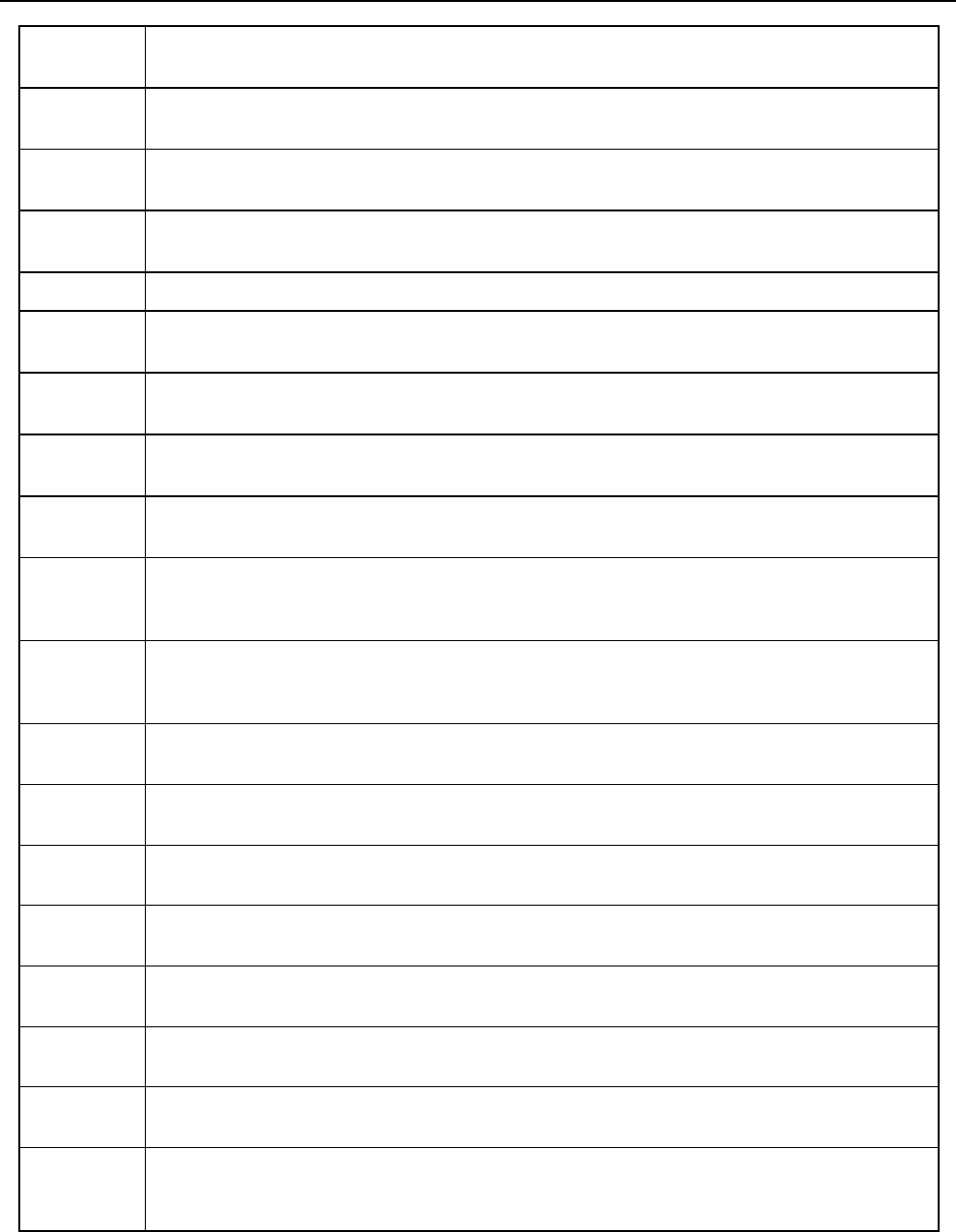

61

(Continued)

FLAG OPTIONS

FLAG

NUMBER

DESCRIPTION

23

0 = Print the time on the receipt / journal.

1 = Do not print the date on the journal at Registration mode.

24

0 = Print the date on the receipt / journal at Registration mode.

1 = Do not print the date on the receipt / journal at Registration mode.

25

0 = Print “,” (comma) as punctuation symbol.

1 = Print “.” (period) as punctuation symbol.

26

0 = Not used.

27

0 = Print receipt after Finalized.

1 = Print receipt after Registration.

28

0 = Print journal after Finalized.

1 = Print journal after Registration.

29

0 = Print the transaction number (consecutive number) on the receipt / journal.

1 = Do not print the transaction number (consecutive number) on the receipt / journal.

30

0 = Print the item count on the receipt / journal.

1 = Do not print the item count on the receipt / journal.

31

VAT TAXABLE PRINT

0 = Do not Print the Value Added Tax (VAT) on the receipt / journal.

1 = Print the Value Added Tax (VAT) on the receipt / journal.

32

VAT TAX PRINT

0 = Do not print the VAT separately for items which are taxable.

1 = Print the VAT separately for items which are taxable.

33

0 = Do not print taxable amount on the receipt.

1 = Print taxable amount on the receipt.

34

0 = Print the summary tax amount of tax 1, 2, 3, 4.

1 = Print the individual tax amount of tax 1, 2, 3, 4.

35

0 = Print tax symbol on receipt.

1 = Do not print tax symbol on receipt.

36

0 = Do not print tax rate on receipt.

1 = Print tax rate on receipt.

37

0 = Print voided amounts on the reports.

1 = Do not print voided amounts on the reports.

38

0 = Print the grand total amount on the reports.

1 = Do not print the grand total amount on the reports.

39

0 = Print the total sales for departments on the reports.

1 = Do not print the total sales for departments on the reports.

40

NON - TAXABLE TOTAL

0 = Print non-taxable total on reports.

1 = Do not print non-taxable total on reports.