113

Appendix 2

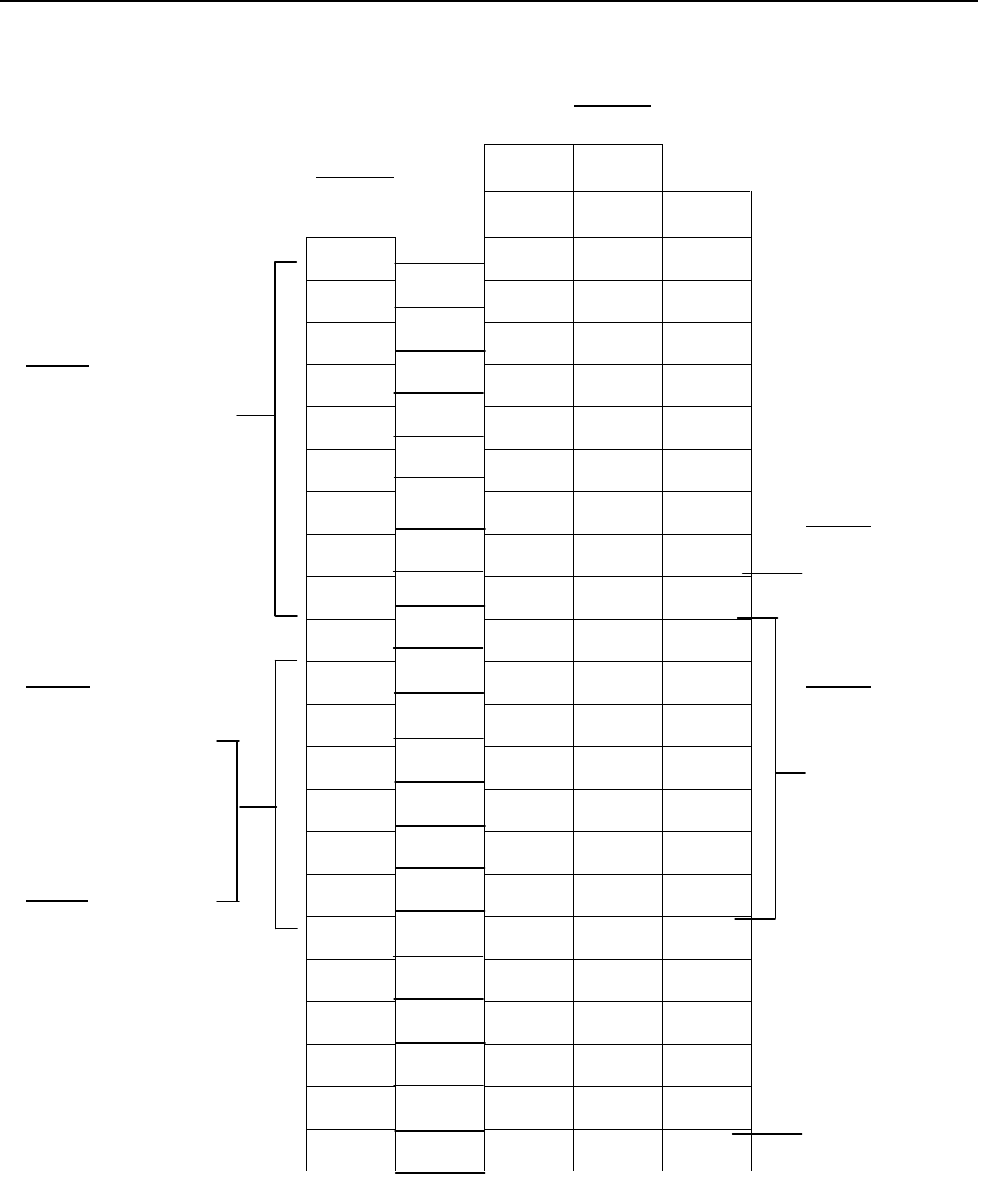

CALCULATING STATE TAX TABLE CODES

Program Example

CHART A

TAX BRACKET

CHART B

From To Tax

Breakpoints

$0.00 $0.14 $0.00

15 0.15 0.37 0.01

23 0.38 0.62 0.02

25 0.63 0.87 0.03

25 0.88 1.12 0.04

25 1.13 1.42 0.05

30 1.43 1.78 0.06

36 1.79 2.12 0.07

34 2.13 2.42 0.08

30 2.43 2.71 0.09

29 2.72 2.99 0.10

28 3.00 3.28 0.11

29 3.29 3.57 0.12

29 3.58 3.85 0.13

28 3.86 4.14 0.14

29 4.15 4.42 0.15

28 4.43 4.71 0.16

29 4.72 4.99 0.17

28 5.00 5.28 0.18

29 5.29 5.57 0.19

29 5.58 5.85 0.20

" " "

Note: If necessary, a total of 65 Breakpoints can be programmed.

STEP F

Enter the individual

Breakpoints of the

“Regular” Breakpoint

sequence.

(29,28,29,29,28,29,28)

STEP E

Enter the individual

Breakpoints of the

“Irregular” Breakpoint

sequence.

(15,23,25,25,25,30,36,

34,30)

STEP C

Enter the summation of

the Breakpoints for the

“Regular” Breakpoint

sequence. (200)

STEP B

Enter first amount of the

last tax bracket in the

“Irregular” breakpoint

sequence. (243)

STEP D

Enter the difference

between the last tax

amount applicable to

the “Regular”

Breakpoint sequence

and the last tax amount

applicable to the

“Irregular” Breakpoint

sequence. (7)

The tax table will

progress in a similar

manner.

abcoffice

www.abcoffice.com 1-800-658-8788