10. REGISTERING PROCEDURE AND PRINT FORMAT

EO1-11110

10-37

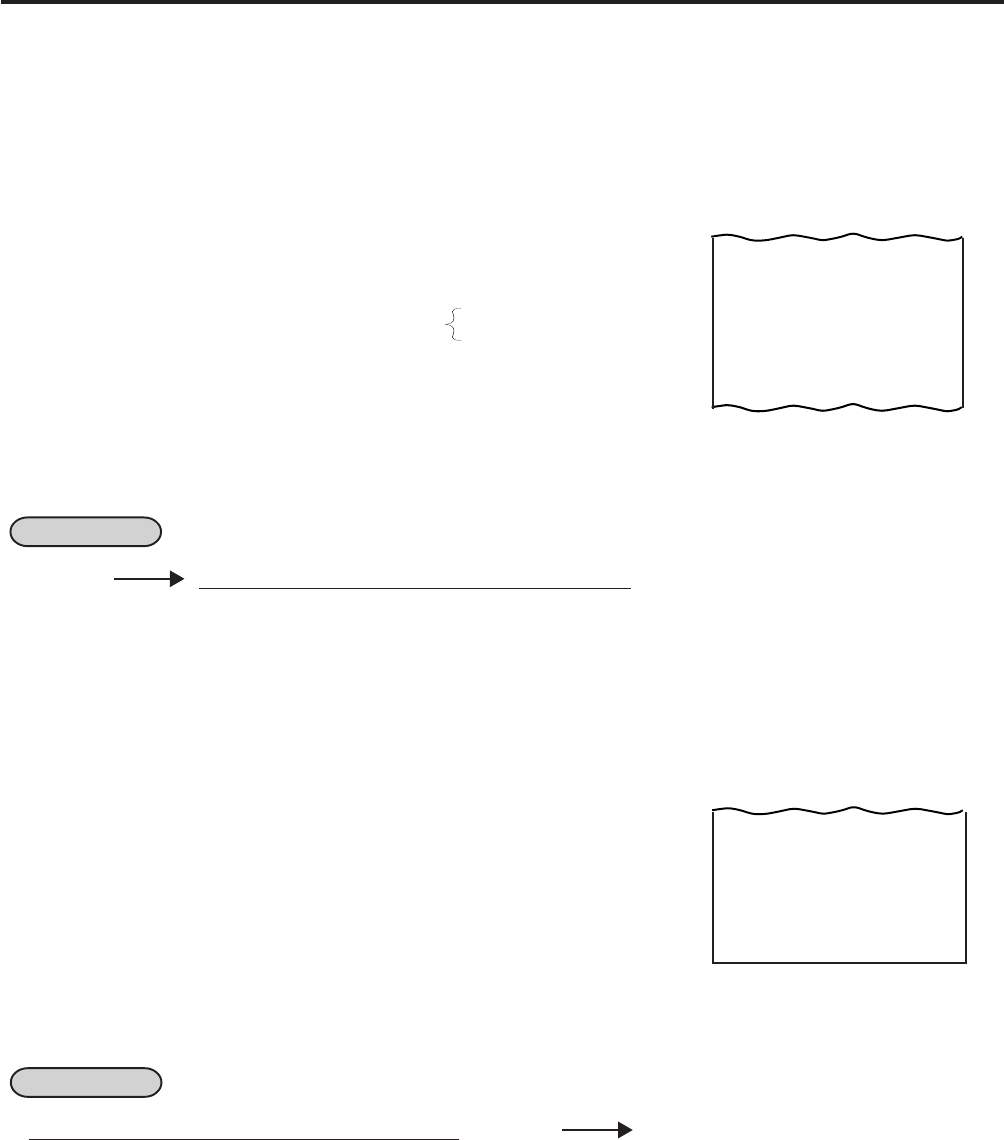

10.51 NO-SALE EXCHANGE from Foreign Currency to Domestic Currency

TAX $0.48

TOTAL $

8

.

48

CUR1 50.00

5,3729

*

CATEND $9.31

CHANGE $0.83

Amount of CUR2 to be exchanged

Exchange Rate (optional print)

Domestic Currency amount equivalent to the CUR2

CUR2 10,00

1,7619

*

CHANGE $5,68

BROWN 0197 18:02TM

Amount Tendered in CUR1

CUR1 Exchange Rate

Optional Print

4. The foreign currency keys cannot be used to finalize Received-on-Account payments, Paid-out

items, or charge posting (sale with previous balance).

5. When a tendering by a foreign currency occurs during a short-tendered condition, the [ST] key

will not be mandatory.

6. A sale of zero or negative balance cannot be finalized using any of the foreign currency keys.

-- Receipt Print Format --

10.51 NO-SALE EXCHANGE from Foreign Currency to Domestic Currency

OPERATION (must be operated outside a sale)

[CUR1] |Amount of Foreign Currency 1 to be exchanged| [NS]

... The drawer opens to enable exchange. Displays the domestic currency amount equivalent to the entered

foreign currency amount.

NOTES: 1. The [CUR 2] to [CUR 5] keys operate the same.

2. The fraction process method is fixed to Round OFF.

-- Receipt Print Format --

10.52 NO-SALE EXCHANGE from Domestic Currency to Foreign Currency

OPERATION (must be operated outside a sale)

|Amount of Domestic Currency to be exchanged| [CUR 1] [NS]

... The drawer opens to enable exchange. The display content of the CUR 1 value obtained on the [CUR1] key

depression is held.

NOTES: 1. The [CUR 2] to [CUR 5] keys operate the same.

2. This operation (exchange from domestic to foreign currencies) may be prohibited by a program

option.

3. The fraction process method is ruled by “Foreign Currency Rounding Process Setting”.