7-6

Investment appraisal can be used to clearly determine whether an investment is realizing

profits that were originally targeted.

S\NPV

n

: natural number up to 254

S\NFV

S\IRR

In this formula, NPV = 0, and the value of IRR is equivalent to i × 100. It should be noted,

however, that minute fractional values tend to accumulate during the subsequent calculations

performed automatically by the calculator, so

NPV never actually reaches exactly zero. IRR

becomes more accurate the closer that NPV approaches to zero.

S\PBP

n

: smallest positive integer that satisfies the conditions NPVn 0, NPVn+1 0, or 0

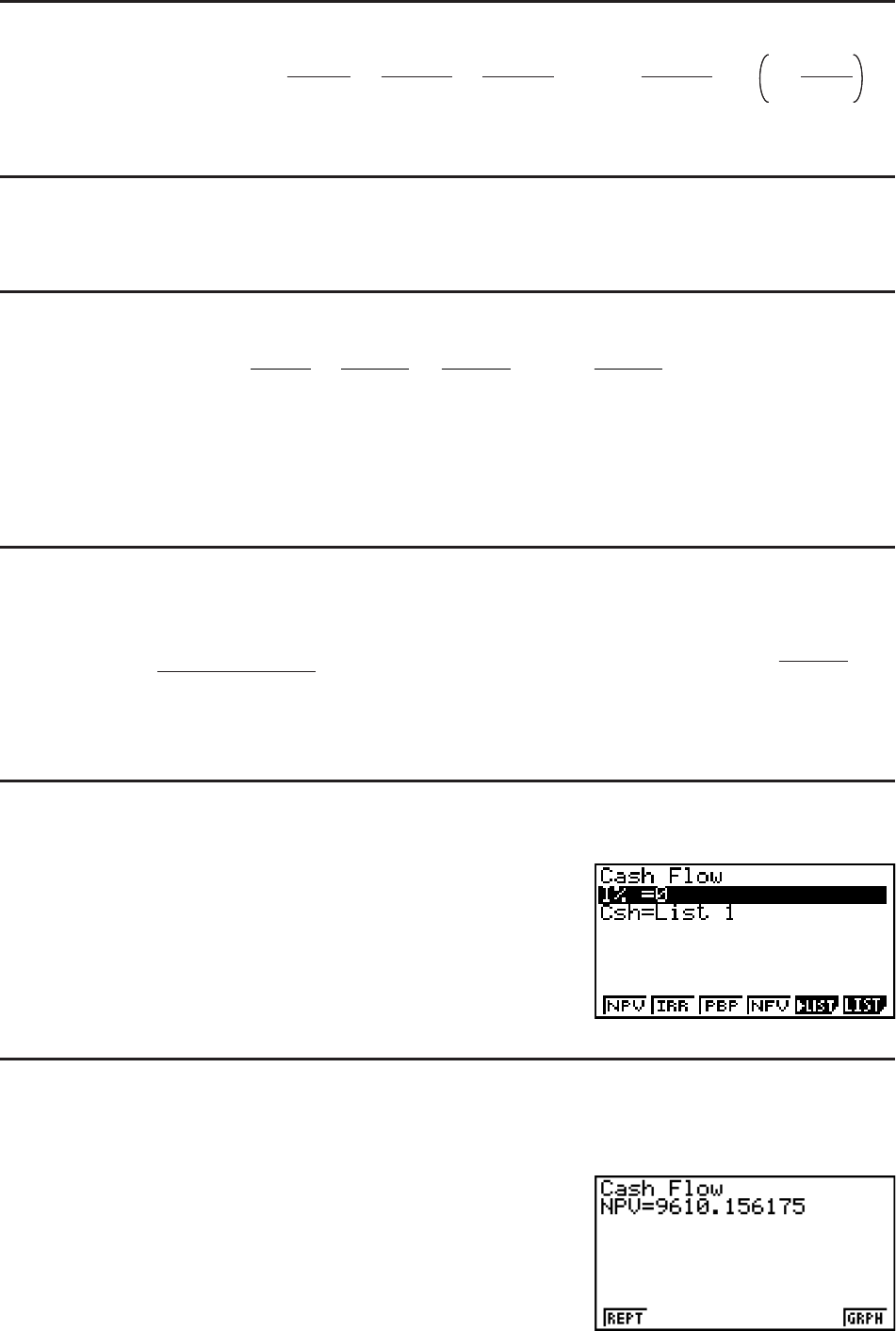

Press (CASH) from the Financial 1 screen to display the following input screen for Cash

Flow.

(CASH)

I% ........ interest rate

Csh ....... list for cash flow

If you have not yet input data into a list, press (LIST) and input data into a list.

After configuring the parameters, use one of the function menus noted below to perform the

corresponding calculation.

• {NPV} … {net present value}

• {IRR} … {internal rate of return}

• {PBP} … {payback period}

• {NFV} … {net future value}

• {LIST} … {inputs data into a list}

• {LIST} … {specifies a list for data input}

NPV = CF0 + + + + … +

(1+ i)

CF

1

(1+ i)

2

CF2

(1+ i)

3

CF3

(1+ i)

n

CFn

i =

100

I %

NPV = CF0 + + + + … +

(1+ i)

CF

1

(1+ i)

2

CF2

(1+ i)

3

CF3

(1+ i)

n

CFn

i =

100

I %

NFV = NPV s(1 + i )

n

NFV = NPV s(1 + i )

n

0 = CF0 + + + + … +

(1+ i)

CF

1

(1+ i)

2

CF2

(1+ i)

3

CF3

(1+ i)

n

CFn

0 = CF0 + + + + … +

(1+ i)

CF

1

(1+ i)

2

CF2

(1+ i)

3

CF3

(1+ i)

n

CFn

NPVn =

n

k

= 0

CFk

(1 + i)

k

PBP =

{

0 .................................. (CF0 > 0)

n –

NPV

n

NPVn+1 – NPVn

(Other than those above)

...

NPVn =

n

k

= 0

CFk

(1 + i)

k

PBP =

{

0 .................................. (CF0 > 0)

n –

NPV

n

NPVn+1 – NPVn

(Other than those above)

...