3. CAPACITIES

EO3-11106

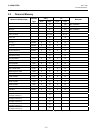

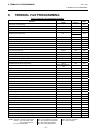

3.6 Memory Balance

3- 9

3.6 Memory Balance

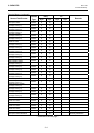

1. GT (Grand Total) = Sum of Daily GS (Gross Sale)

2. NET GT = Sum of Daily Net Sales

3. NEG GT = GT – NET GT

4. GS (Gross Sale) = (Sum of Positive Depts) + (Sum of Add-on Taxes)

NOTE 1

5. Net Sale = GS – (Sum of Negative Depts) + (%+) – (%-) – (Vender Coupon)

– (Amount Discount) + (Special Rounding Fraction)

NOTE 2

= (Cash Sales) + (Sum of all other media sales) + (Previous Balance Sales)

= (Sum of Hourly Sales)…

If Financial Reset Report and Hourly Range Reset Report are taken at the

same time.

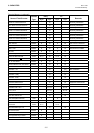

6. Negative Mode Total = (Net Sale + Received-on-Account + Paid-Out ) in Negative Mode

7. Net Sale without Tax (N.NS) = (Net Sale) – (Sum of VATs)…

applicable only when the VAT feature is selected

8. Net Sale Item Count per Customer = (Item Count of Net Sale) ÷ (Customer Count of All-media Sales)

All-media Sales per Customer = (Amount of All-media Sales) ÷ (Customer Count of All-media Sales)

NOTES: 1. Applicable only when the Add-on Tax feature is selected.

2. Special Rounding Fraction amounts for Received-on-Account and Paid Out transactions are not

correctly processed into the memory.