12-6 Using the Finance Solver

Example 2 - Mortgage with balloon payment

Suppose you have taken out a 30-year, $150,000 house

mortgage at 6.5% annual interest. You expect to sell the

house in 10 years, repaying the loan in a balloon

payment. Find the size of the balloon payment, the value

of the mortgage after 10 years of payment.

Solution. The following cash flow diagram illustrates the

case of the mortgage with balloon payment:

• Start the Finance Solver, selecting P/YR = 12 and

End payment option.

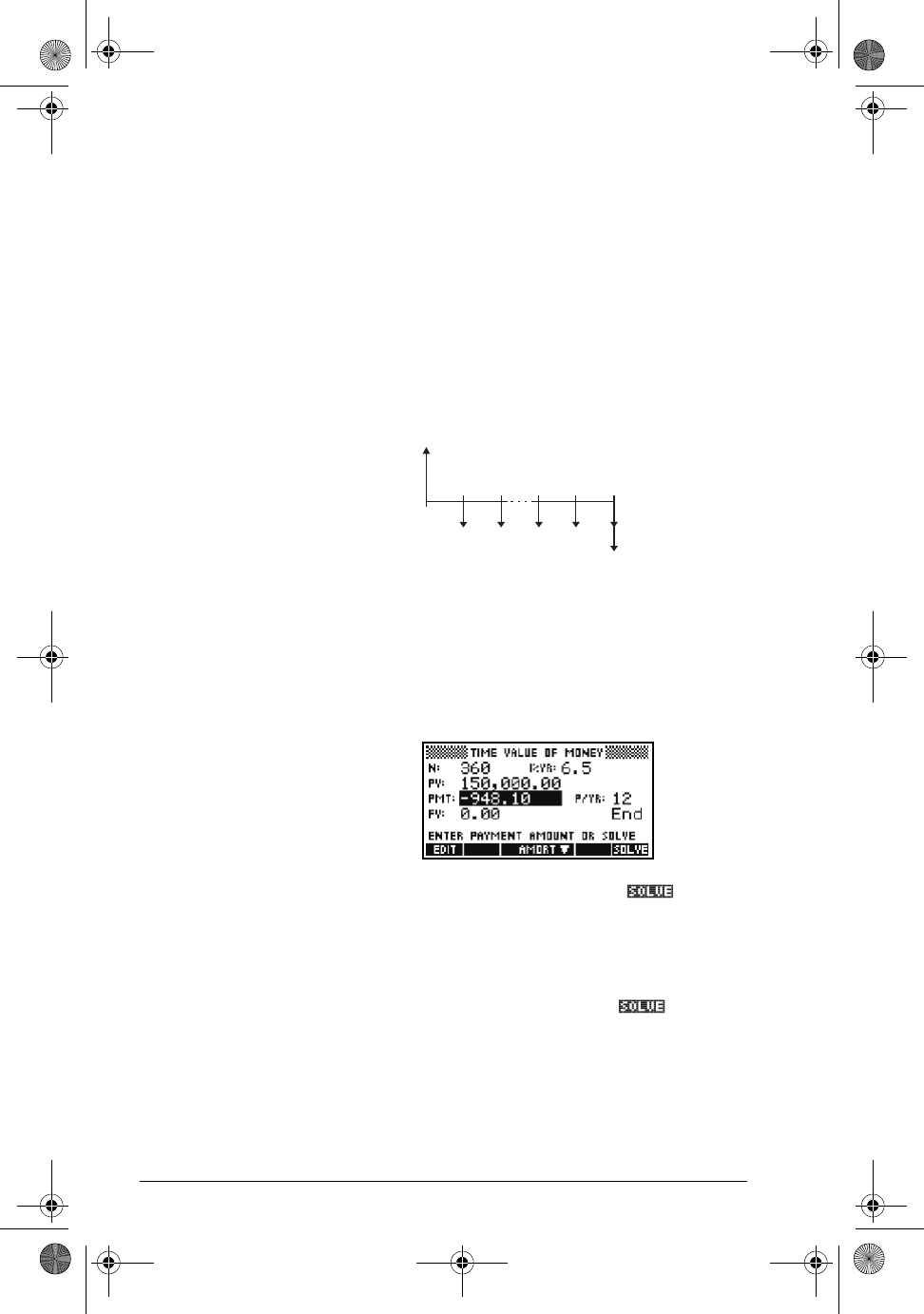

• Enter the known TVM variables as shown in the

diagram above. Your input form, for calculating

monthly payments for the 30-yr mortgage, should

look as follows:

• Highlighting the PMT field, press the soft

menu key to obtain a payment of -948.10 (i.e., PMT

= -$948.10)

• To determine the balloon payment or future value (FV)

for the mortgage after 10 years, use N = 120,

highlight the FV field, and press the soft menu

key. The resulting value is FV = -$127,164.19. The

negative value indicates a payment from the

homeowner. Check that the required balloon

payments at the end of 20 years (N=240) and 25

years (N = 300) are -$83,497.92 and

-$48,456.24, respectively.

PV = $150,000

1

2

59

60

l%YR = 6.5

N = 30 x 12 = 360 (for PMT)

N = 10 x 12 = 120 (for balloon payment)

P/YR = 12; End mode

PMT = ?

Balloon payment,

FV = ?

hp40g+.book Page 6 Friday, December 9, 2005 1:03 AM