190

Chapter 11: Financial Features

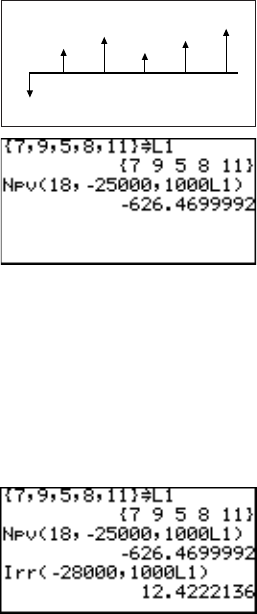

06 Npv ( Npv (

Interest rate, initial investment, list of following col-

lected investment [, frequency list]

)

Calculates the net present value and evaluates the validity of the

investment. You can enter unequal cash flows in the list of

following collected investment.

Example

The initial investment is $25,000

planning to achieve the profits

each year as shown on the

right, Evaluate whether annual

revenue of 18% is achieved.

*You can execute the calcula-

tion by using a list or a

frequency list calculation.

The result indicates that annual revenue of 18% cannot be

secured.

07 Irr ( Irr (

initial investment, list of following collected investment [,

frequency list] [, assumed revenue rate]

)

Calculates the investment revenue rate where the net present

value is 0.

Example

If the investment for the sales

plan in the previous example is

$28,000, how much is the

investment revenue rate?

• 12.42 is obtained as the

answer, thus, the investment revenue rate for the above

condition is 12.42%.

* In the previous example, revenues following the investment

value (input using minus sign) were assumed to be positive.

However, when the assumed revenue is set to minus (in other

words, more than two inverse symbols), the assumed revenue

rate must be entered at the end. Otherwise an error may occur.

$25,000

$7K

$9K

$5K

$8K

$11K

12345

Year