7-13

S Declining-Balance Method (DB)

DB

j : depreciation charge for the jth year

RDVj : remaining depreciable value at the

end of jth year

I% : depreciation factor

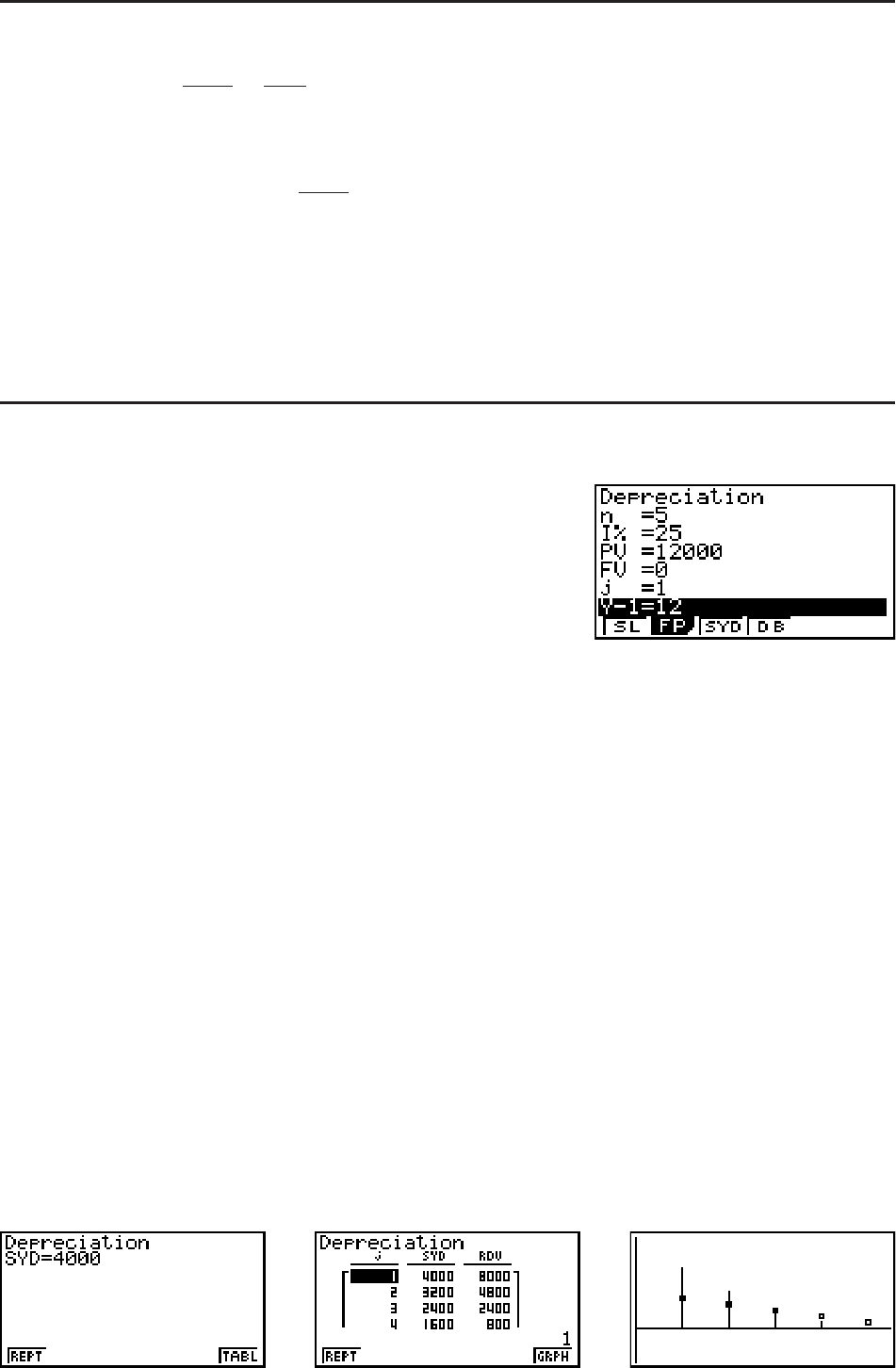

Press (DEPR) from the Financial 2 screen to display the following input screen for

depreciation calculation.

(E)(DEPR)

n............ useful life

I% ......... depreciation ratio in the case of the fixed percent (FP) method, depreciation factor in

the case of the declining balance (DB) method

PV......... original cost (basis)

FV......... residual book value

j............. year for calculation of depreciation cost

Y−1........ number of months in the first year of depreciation

After configuring the parameters, use one of the function menus noted below to perform the

corresponding calculation.

• {SL} … {Calculate depreciation for year

j using the straight-line method}

• {FP} ... {FP} ....{Calculate depreciation for year

j using the fixed-percentage method}

{I%} .....{Calculate depreciation ratio}

• {SYD} … {Calculate depreciation for year

j using the sum-of-the-years’-digits method}

• {DB} … {Calculate depreciation for year

j calculated using the declining-balance method}

Calculation Result Output Examples

{SYD} {SYD} − {TABL} {SYD} − {GRPH}

RDV1 = PV – FV – DB1

({Y–1}x12)

({Y–1}x12)

100n

Y–1I%

DB

1 = PV s

100n

I%

12

s

s

DB

j = (RDVj–1 + FV )

RDVj = RDVj–1 – DBj

DBn +1 = RDVn

RDVn+1 = 0

RDV

1 = PV – FV – DB1

({Y–1}x12)

({Y–1}x12)

100n

Y–1I%

DB

1 = PV s

100n

I%

12

s

s

DB

j = (RDVj–1 + FV )

RDVj = RDVj–1 – DBj

DBn +1 = RDVn

RDVn+1 = 0