7-14

An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function menu to maneuver between calculation result screens.

• {REPT} … {parameter input screen}

• {TABL} … {displays table}

• {GRPH} … {draws graph}

10. Bond Calculations

Bond calculation lets you calculate the purchase price or the annual yield of a bond.

Before starting bond calculations, use the Setup screen to configure “Date Mode” and

“Periods/YR.” settings (page 7-1).

S Formula

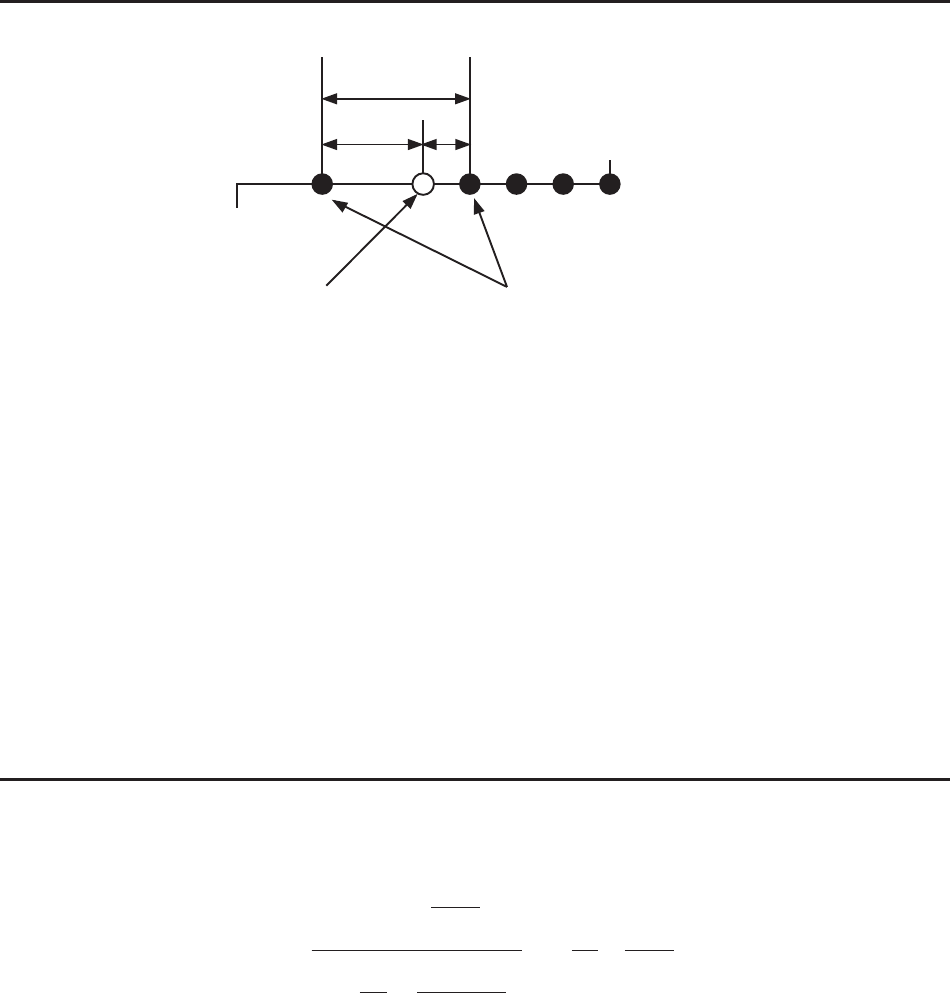

D

Issue date

Redemption date (d2)

Purchase date (d1) Coupon Payment dates

AB

PRC : price per $100 of face value

CPN : annual coupon rate (%)

YLD : yield to maturity (%)

A : accrued days

0 : number of coupon payments per year (1=annual, 2=semi annual)

N : number of coupon payments between settlement date and maturity date

RDB : redemption price or call price per $100 of face value

D : number of days in coupon period where settlement occurs

B : number of days from settlement date until next coupon payment date=D−A

,17 : accrued interest

&67 : price including interest

S Price per $100 of face value (PRC)

• For one or fewer coupon period to redemption

PRC = +(–)

RDV +

M

CPN

1+ ( × )

D

B

M

YLD/100

×

D

A

M

CPN

PRC = +(–)

RDV +

M

CPN

1+ ( × )

D

B

M

YLD/100

×

D

A

M

CPN