- 28 -

EO1-11116

MA-516-100 SERIES

Example) $20.00

Setting the Non-taxable Limit Amount

(applicable to only certain areas in Canada)

This non-taxable amount limit must be set only in certain areas in Canada.

Condition for Setting: After Daily Financial Reset

(refer to “NOTE on Condition” on page 22.)

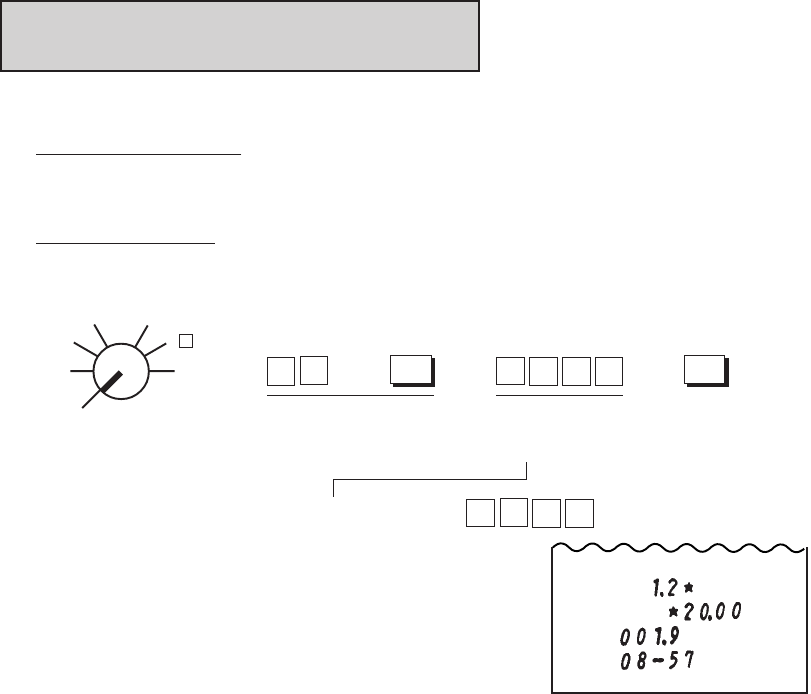

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

0

→

OFF

Z

REG

X

SET

MGR

-

1

→

@/FOR

0

2

→

AT/TL

0

→

2

Declaration of Program No. 12

for Non-taxable Limit Amount

Setting

Non-taxable Limit

Amount (max. 4 digits;

1 to 9999¢, or enter 0¢

to reset the limit)

NOTES 1 . When the sum of the sale portion subject to Tax (PST) 1 and the sale portion subject to Tax

(PST) 2 exceeds the Non-taxable Limit Amount programmed here, all the amount subject

to either of the two taxes are all taxed. When the sum is less than the programmed limit, Tax

1 is tax-exempted and only Tax 2 is calculated on the sale portion subject to Tax 2.

2. When the sum of the sale portion subject to Tax (PST) 1 and the sale portion subject to Tax

(PST) 2 is negative, the portion subject to Tax 1 will not be taxed.

3. When the sale portion subject to Tax 1 is tax-exempted, the taxable amount is not stored in

Tax 1 memory.

4. An error results when the [GST/M] key is depressed in sale entries on the ECR with Non-

taxable Limit Amount programmed.

5. This setting must not be operated when Food Stamps are handled in transactions.