- 84 -

EO1-11116

MA-516-100 SERIES

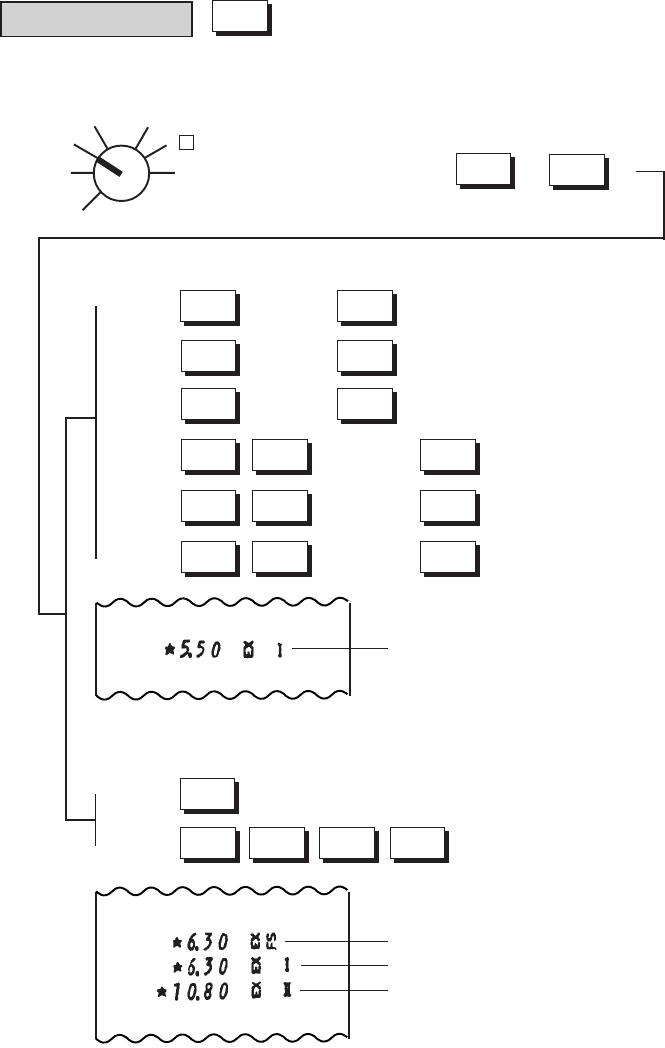

To exempt the sale from designated taxes:

(Exemption from Tax/PST 1 only)

(Exemption from Tax/PST 2 only)

(Exemption from GST only)

(Exemption from Tax/PST 1 & Tax/PST 2)

(Exemption from Tax/PST 1 & GST)

(Exemption from Tax/PST 2 & GST)

All the items are

entered for the

customer.

Tax Exemption (Tax Exempt Key)

When an entire sale must be exempted from designated or all taxes (Tax/PST 1, Tax/PST 2, GST), the [EX] key is

used near the end of the sale finalization. (To exempt an individual item from designated taxes, only Tax Modifier Keys

are used in entering the item.

Refer to the section “Tax Modification” on page 66.

)

EX

OFF

Z

REG

X

SET

MGR

-

→

( or )

ST

TXBL

TL

→ →

→ →

→ →

→ →

→ →

→ →

TX1/M

TX1/M

GST/M

TX2/M

EX

EX

EX

TX2/M

EX

GST/M EX

GST/M EX

TX1/M

TX2/M

The sale portion (pre-taxed amount) subject to the tax exemp-

tion (Tax/PST 1 in this example).

At the same time, the display shows the Sale Total due

(including non-exempted taxes and excluding exempted taxes).

To exempt the sale from all taxes:

or

Sale portion (pre-taxed) exempted from GST

Sale portion (pre-taxed) exempted from Tax/PST 1

Sale portion (pre-taxed) exempted from Tax/PST 2

At the same time, the display shows the Sale Total due

(excluding all taxes).

TX2/M

GST/M

EX

→

→

TX1/M

EX