- 78 -

EO1-11116

MA-516-100 SERIES

When the amount tendered is smaller than the sale total:

Displays the balance due (shortage), with the “ST” lamp illuminated.

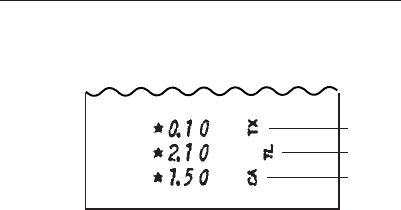

Prints “TX”, “TL”, and “CA”(short-tendered cash amount).

The sale is not finalized.

(Refer to the section “Multi-tender, Split Tender”.)

Tax amount (added to the sale)

Sale Total including tax

Cash Amount tendered (short-tender)

NOTES 1. The [AT/TL] key functions as Total Key if simply pressed, or as Tender Key if pressed with a prior

amount entry. However, it can be programmed to be used as Tender Key only (refer to Chapter

“22. System. Option Setting”, Address 6- Bit 1 on page 124.)

2. When the sale total is zero or negative, only the Total Key function is effective regardless of the

key option selection described in NOTE 1 above.

3. When the option “Taxable Total Compulsory” (refer to Chapter “22. System Option Setting”,

Address 2- Bit 4 on page 120) is selected, the sale is finalized only after reading the sale total

(by [ST] or [TXBL TL])

4. When the option “Short-tendering Prohibited” is selected (refer to Chapter “22. System Option

Setting”, Address 11- Bit 1 on page 129), short-tendering is not possible.

5. The [AT/TL] key is also used to finalize a Received-on-Account or Paid Out transaction. (Refer

to the respective sections.)

6. When a sale is partially paid in food stamps, Food Stamp Tender must be operated first. (Refer

to the preceding section.)

7. The [CASH 1] to [CASH 3] keys (Key Codes 117 to 119; refer to Chapter “15. Optional Key

Setting” on page 30) can perform cash tendering operations in sales entries with the respective

preset tendering amounts. On how to set those amounts to the [CASH 1] to [CASH 3] keys, refer

to the description on the next page.