- 34 -

EO1-11116

MA-516-100 SERIES

[TAX] (Manual Tax Key) ... Key Code 100

It is used to enter an irregular tax amount that cannot be calculated on the basis of the

programmed tax tables, and to add it to the sale total. For installing this key, please note the

following in entering Key Code 100:

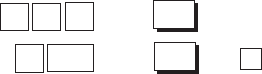

Right: The last key is correctly set with Key Code 100 ([TAX])

Wrong: The 00 key is newly set with Key Code 1, which is

Department 1 Key. The last key is not set with any Key

Code.

[GST/M] (GST Modifier Key)... Key Code 115 (common Key Code with [FS/M])

It is necessary in the GST-applicable area in Canada. It reverses the GST taxable/non-

taxable status of items. Whether the key with Key Code 115 is used as [FS/M] or [GST/M]

is determined by System Option, Address 14 - Bit 1 status (refer to page 132).

[CASH1] to [CASH3] (Cash Tender Keys 1 to 3) ... Key Codes 117 to 119

They are used for cash-tendering operations.

[CUR1] to [CUR4] (Foreign Currency Keys 1 to 4) ... Key Codes 121 to 124

They are used to finalize a sale with foreign currencies.

9. If any of the following keys are newly installed or its location is changed, its relevant programming

operations are further required (even if once programmed, re-programming is necessary

because the program data has been cleared):

Each Department Key ............Department Status, LC (if required), Preset Price (if re-

quired) of the Department

[PLU] ........................................ PLU Table

[TX1/M], [TX2/M], [GST/M]...... Respective Tax Tables or Rates (Tax 1, Tax 2, GST)

[%+], [%–] ................................Respective Foreign Currency Exchange Rates

[CASH1] to [CASH3] ...............Respective Cash Tendering Amounts

[CUR1] to [CUR4] .................... Respective Foreign Currency Exchange Rates

0

1

0

→

Key

1 00

→

Key