- 71 -

EO1-11116

MA-516-100 SERIES

NOTES 1. The Void entries are usually possible only inside a sale. However, when the option “Credit

Balance Allowed” is selected, they are allowed outside a sale as well and over-subtraction of the

sale is also allowed. (Refer to Chapter “22. System Option Setting”, Address 2 - Bit 3 on page

120.)

2. Neither Negative Department nor Negative PLU items can be entered as Void items.

3. A Void entry cannot be item-corrected.

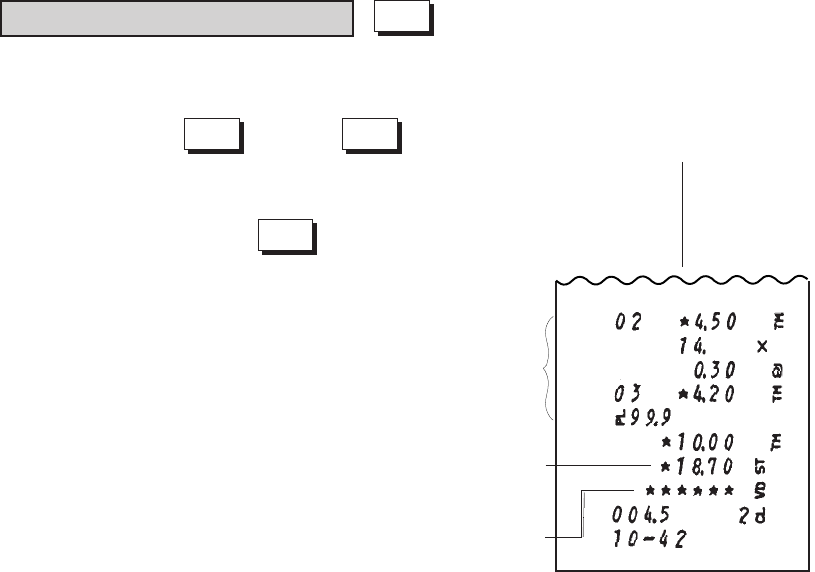

All Void (Transaction Cancel) (All Void Key)

When some items have already been entered in the current sale and the customer cancels the entire contents of the

sale, the [ALL VOID] key is used.

Sale Item

Entries

(Executes the Transaction Cancel, clears the displayed

data, and an All Void receipt is issued.)

ALL

VOID

→

ALL

VOID

ITEM

CORR

C

Declares a

Transaction Cancel.

(Clears the Transaction Cancel

declaration to continue the sale.)

Items already

entered in this sale.

Prints the subtotal (sale total before

taxed) when Transaction Cancel is

executed.

(NOTE 1)

All Void (Transaction

Cancel) Symbol Line.

→

→

NOTES 1. The sale is canceled, therefore, no payment should occur. However, subtotal amount printed on

the All Void receipt is processed into the “All Void” total of the report memory.

2. The All Void operation is no longer acceptable when any media key (such as [AT/TL]) is entered

including short-tendering.

3. If Tax Exempt (using the [EX] key) is entered, the sale can no longer be all-voided.

4. The All Void function is not effective for Received-on-Account or Paid Out transactions.

5. When more than 20 items have been entered in the current sale, the All Void function is no longer

effective.