6. PROGRAMMING OPERATIONS EO1-11152

6.7 PLU Table Programming (Submode 4)

6-24

PLU TABLE PROGRAMMING CONTENTS (continued)

Address No. Description of Programming Contents

5 Status Code 2 Selection

• Enter Codes 2 to 7 (Code 3 is vacant.) whose status must be set to ON side. More than one

code may be entered. Enter 0 when none of the statuses should be set to ON.

NOTES:

Code 1: Price Print

• When this status is set to ON (Non-print), PLU price will not be printed. However, when

the Quantity Extension transaction is performed for the PLU, its price will be always

printed regardless of this status selection. Do not set this status code ON.

Code 2: Tare 3 Entry or Net to Selective Itemizer 4

• The status settings are selected by the system option.

• Do not set the Tare 3 Entry status ON (Compulsory) if a PLU is linked to a Gift Card

department. Doing so may cause an error at the item entry.

Code 4: Tax Symbol “F” Print

• Tax symbol “F” is printed when this status code has been set “ON” to a taxable PLU.

• If the Food Stamp feature has been selected, this symbol “F” will be always printed

regardless of this code status when a food stamp taxable department is entered.

* In Canada, some area handles two kinds of tax; GST and PST. Status Code 4 (Tax

Symbol “F” Print) should be set at the GST status setting.

Tax Symbol “T” ...... PST

Tax Symbol “F” ...... GST

Status Code 6,7: Age Limit Status 2, 1

• When the Age Limit 1 or Age Limit 2 Status is set to ON, the age confirmation is always

necessary before entering a sales item.

• The Age Limit 2 or Age Limit 1 Status (Code 6 or 7) is unavailable for the Scale Entry

Compulsory PLU (Code 5 in Status 1 Selection).

6 Tax Status

• Enter one- to four-digit Status Codes for applicable Taxes.

[#]

0: Non-taxable

1: Tax 1 (Tax 1 taxable)

2: Tax 2 (Tax 2 taxable)

3: Tax 3 (Tax 3 taxable)

4: Tax 4 (Tax 4 taxable)

NOTES: 1. The rate of each Tax will be later be set and described in Section 6.24 Tax

Table Setting.

2. In case of inclusive tax, the combination of the tax status is unavailable. Only

one inclusive tax status can be programmed for a PLU. (Tax 3 taxable or

Tax 4

taxable)

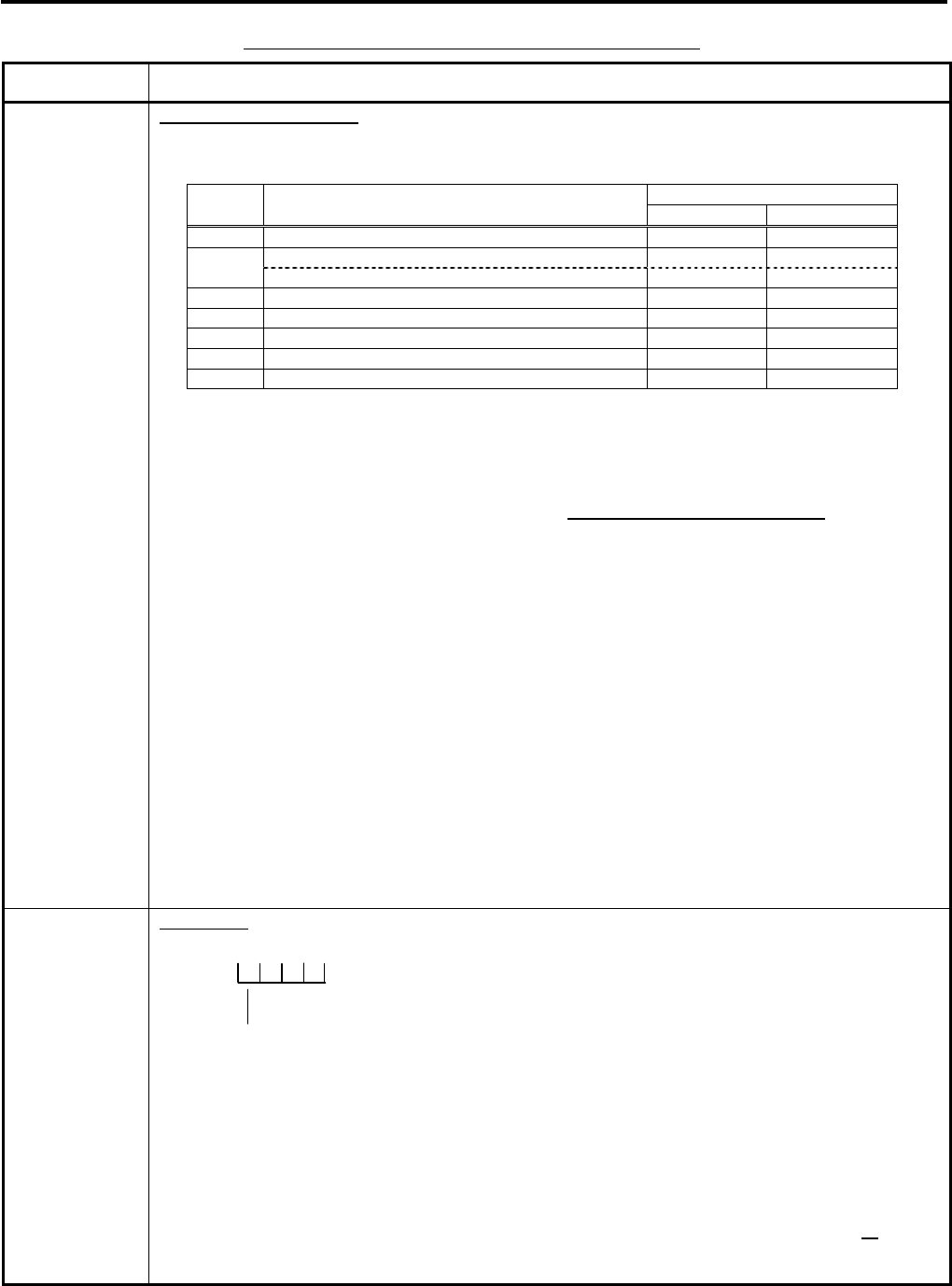

Selective Status

Code Item

ON OFF

1 Price Print Non-print Print

Tare 3 Entry Compulsory

Optional

2

Net to Selective Itemizer 4 Yes No

3 Net to Selective Itemizer 3 Yes No

4 Tax Symbol “F” Print Print Non-print

5 Canada Non-taxable Quantity Objective Not objective

6 Age Limit 2 Status (alcohol) Necessary Unnecessary

7 Age Limit 1 Status (cigarette) Necessary Unnecessary

(More than one code can be entered for

combining Tax1 to Tax4 taxable status.

For example, enter 12 to select Tax1 and Tax2

taxable status.)