4. PROGRAMMING OPERATIONS EO1-11155

4.12 PLU Table Programming

4-37

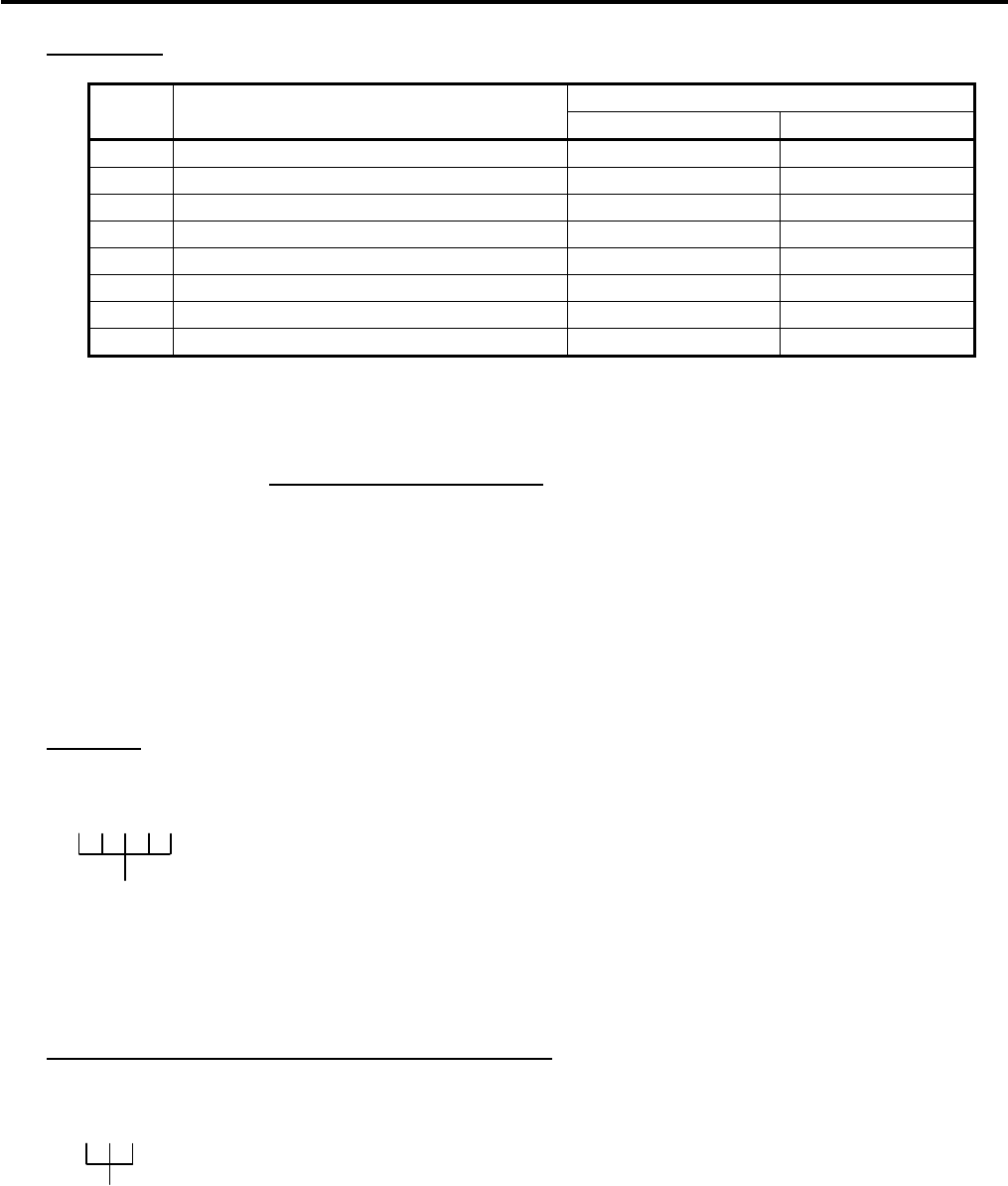

*6: PLU Status 2

• The following shows each department status.

Selective Status

Status

Code

Item

ON (Y) OFF (N)

1 Price Print Non-print Print

2 -- vacant --

3 -- vacant --

4 Tax Symbol “F” Print Print Non-print

5 Canada Non-taxable Quantity Objective Not objective

6 -- vacant --

7 -- vacant --

8 -- vacant --

NOTE:

Code 1: Price Print

When this status is set to ON (Non-print), PLU price will not be printed. However, when the Quantity

Extension transaction is performed for the PLU, its price will always be printed regardless of this

status selection. Do not set this status code ON.

Code 4: Tax Symbol “F” Print

Tax symbol “F” is printed when this code has been set “ON” to a taxable PLU. If the Food Stamp

feature has been selected, this symbol “F” will always be printed regardless of this code status when

a food stamp taxable department is entered.

In Canada, some area handles two kinds of taxes; GST and PST.

Status Code 4 (Tax Symbol “F” Print) should be set at the GST status setting.

Tax Symbol “T” ...... PST

Tax Symbol “F” ...... GST

*7: Tax Status

• Enter one- to four-digit status codes for applicable taxes. Or enter 0 to cancel the taxable status. (i.e.

Non-taxable status is set to the PLU.)

[Enter]

0: Non-taxable

1: Tax 1 (Tax 1 taxable)

2: Tax 2 (Tax 2 taxable)

3: Tax 3 (Tax 3 taxable)

4: Tax 4 (Tax 4 taxable)

*8: Whole Package Quantity (for Split Package Pricing PLUs)

• Enter a whole package quantity in a maximum of 2 digits (1 to 99). Or enter 0 to cancel the Split

Package Pricing status.

[Enter]

0 to 99

(More than one code can be entered for combining Tax 1 to Tax

4

taxable statuses.

For example, enter 12 to select Tax 1 and Tax 2 taxable status.)