11. REGISTERING PROCEDURE AND PRINT FORMAT EO1-11155

11.20 Food Stampable Total Read, Food Stamp Tendering

11-20

11.20 Food Stampable Total Read, Food Stamp Tendering

- - - [FS TL TEND] |Food Stamp Tendered Amount

| [FS TL TEND] - - -

... When the Food Stamp tendered amount is less than the sale total, the sale is not finalized with the balance

still due displayed. Then it can be finalized with cash or other media total or tendering operations.

NOTES: 1. Food Stamp feature is unavailable for the area where inclusive tax feature is used.

2. Any of the following features can be selected by the program option.

1) Normal

The amount including the food stampable tax can be paid by Food Stamp.

2) Illinois

Only the amount paid by Food Stamp is exempted from the food stampable tax.

3) New Jersey

All food stampable tax is exempted regardless of the amount of Food Stamp.

3. Change in unit of $ is paid by Food Stamp, and ¢ is paid by cash.

11.21 Tax Calculation and Print

Your ECR has been programmed with proper tax tables (tax breaks and/or tax rates).

Each department or PLU has been programmed with proper tax status, i.e. taxable or non-taxable status of each

Tax (of maximum 4 taxes of Tax 1 to Tax 4).

On finalizing a sale, the taxes due are automatically calculated and printed on the receipt, and thus added to the

sale.

Whether all taxes (Tax 1 to Tax 4) are consolidated into one line print or individually printed in separate lines is a

program option.

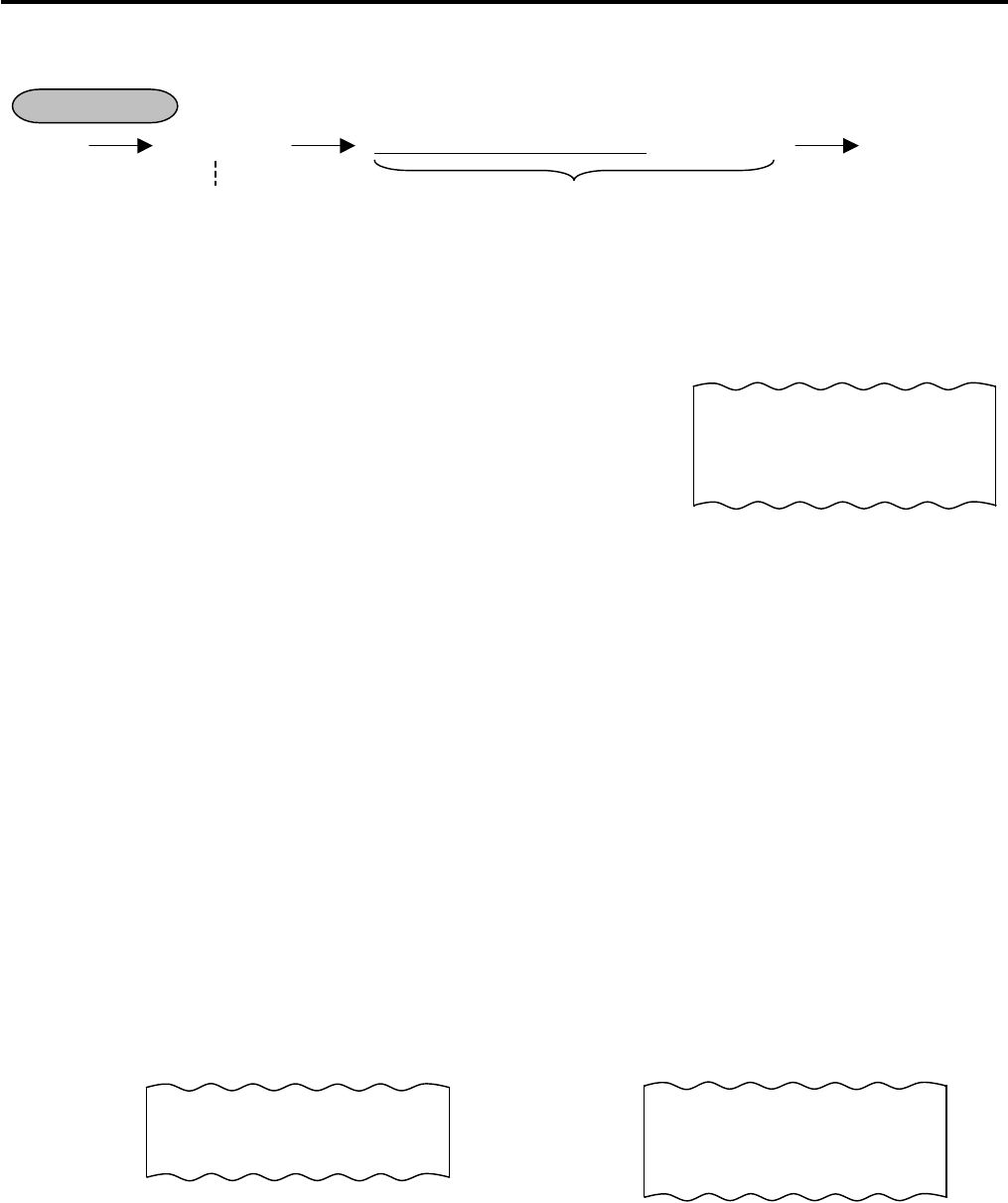

-- Receipt Print Format --

OPERATION

Displays the Food

Stampable Total

Tendering in Food Stamp

(This must be operated first of all the

payments in finalizing the sale if food

stamps are part of the payment.)

Entire Sale Total

Food Stampable Total

Food Stamp Tendered Amount

Change in Cash

Change in Food Stamp

TOTAL $

12.72

FS/TL $12.72

F-STMP $15.00

CHANGE $0.28

FS CHG $2.00

Example of

Consolidated

Print Line

Example of

Separate Print

Lines

SUBTL $15.00

TAX1 $0.60

TAX2 $0.25

CASH $

15.85

SUBTL $15.00

TAX $0.85

CASH $

15.85